XRP Valuation

UPDATE - November 11, 2017:

I NO LONGER AGREE WITH THE BELOW ANALYSIS.

I have updated my thoughts and valuation in the following note:

http://cryptoizzy.blogspot.com/2017/11/goodbye-to-ripple.html

I am leaving this note here, but please take this warning and review my new piece.

Best,

Izzy

Follow @cryptoizzy

XRP/RIPPLE VALUATION – By Ihsotas Otomakan (IzzyOtto)

I NO LONGER AGREE WITH THE BELOW ANALYSIS.

I have updated my thoughts and valuation in the following note:

http://cryptoizzy.blogspot.com/2017/11/goodbye-to-ripple.html

I am leaving this note here, but please take this warning and review my new piece.

Best,

Izzy

Follow @cryptoizzy

XRP/RIPPLE VALUATION – By Ihsotas Otomakan (IzzyOtto)

Introduction

I hope you find my thought processes interesting and helpful in your exploration of cryptos.

Please be aware that I’m neither giving investment advice nor suggesting anyone buy or sell anything. I’m simply sharing my personal assessment process for determining value.

The main difficulty in arriving at a valuation is dealing

with uncertainty. I have striven to be clear about my assumptions and estimates,

but I have no doubt that even if I am proven largely correct over the course of

time, many of the details to my analysis will be changed and refined.

If you have a particular question or response to my methodology, I invite you

to contact me at izzyotomakan@gmail.com.

I’ll do my best to respond, and if appropriate, may post edits/updates to this

analysis.

I also have additional thoughts on cryptos that I plan on sharing. If you'd like to be kept up on these, please either follow this blog or just let me know via email. Thanks.

Best,

Izzy

On Cryptocurrency Valuation

Methodologies

The exercise of applying traditional asset valuation metrics

to a cryptocurrency is considered by many as lying somewhere between unwieldy

and impossible. Modern financial and portfolio theories generally view asset

valuation as being an exercise in determining the present value of cash flow

streams which may be generated in the future. As cryptocurrencies have no

innate cash-flow generating ability, this approach quickly hits a dead end.

Trying to approach cryptocurrencies from the perspective of traditional

currencies (ie, USD, GBP, EUR) similarly falls short. All extant global

currencies are intimately tied to the economic, political and legal structures

of a sponsoring country (or group of countries). Cryptocurrencies, existing

independently of nation-state sponsors, lack any of the metrics that would be

appropriate for such an exercise.

As a consequence of the inapplicability of these traditional

approaches, any sound and reasoned cryptocurrency valuation must employ novel

methodologies and perspectives. My endeavor in this analysis is to provide just

such a different framework, which if successful will appear both rational and

perhaps even obvious in hindsight.[1]

In any case, though I will provide data where both relevant and available, I

will largely rely upon a series of logical steps which if followed to

conclusion will yield what I believe to be a valuation floor for Ripple. Please

note that this analysis is only meant to describe a valuation floor, that is a minimum functional

value according to a singular approach. It is my opinion that when other

approaches are applied to cryptocurrency valuation (including, but not limited

to Ripple), the ultimate valuation may be substantially higher than that which

we will arrive at in this report. Nevertheless, while I save that fuller

approach for a future analysis to be shared, I am pleased to be able to

represent that the (more limited) valuation approach which I present here still

demonstrates substantial upside versus the current trading levels of Ripple

coins.

What makes Ripple a

unique candidate for this valuation analysis?

To answer this question we must first consider the

proposition that most crypto-coins lack significant value outside of their use as money. This may sound like an obvious or

even foolish statement at first glance, but it’s a necessary starting point. When

we realize that even this value is dependent on the size of the economic

community which agrees that ‘it is

money’ (both in theory and practice),

we quickly realize that in this regard most crypto-coins are currently at a

significant disadvantage relative to state-sponsored currencies.

A state-sponsored currency almost definitionally has a

significant economic community that agrees ‘it is money’. This occurs by virtue

of the fact that the state sponsor declares their currency to be ‘legal tender’

– viewed in the eyes of their courts (and tax authorities) as an acceptable means

to satisfy economic obligations[2].

So long as individuals accept the government’s rule of law in a country, they

also implicitly become members of the economic community which accepts that

currency as money.

Many proponents of Bitcoin (and cryptocurrencies in general)

argue that in time, the size of the community which accepts cryptos ‘as money’

will grow, irrespective of legal tender recognition. This may ultimately be so,

but for current valuation purposes yields ill-defined parameters for

assessment. As such, we may ask another question: Is there a basis outside of

use ‘as money’ which may be used to establish a valuation framework for a

cryptocurrency? The short answer to this question is yes – and it lies in what

I refer to as functional utility (a

fancy way of saying its used for some purpose).[3]

Many cryptocurrencies do

exhibit some functional utility outside of their use as traditional money. For

example, they may serve as means and methods of crowd-funding investment

projects, rewarding social community behavior, or facilitating complex

contractual arrangements (more on this shortly). However, while some of these

uses may ultimately result in

significant functional-utility value, the vast majority of cryptos currently lack a clear pathway to

realize this value – much less point to a valuation that exceeds current

trading levels. And this, is where Ripple is different.

Ripple is relatively unique amongst cryptocurrencies in that

it:

a)

Has a clearly quantifiable functional-utility

value apart from any wider general acceptance

as ‘money’, AND

b) That

functional-utility valuation appears to be significantly higher than

current trading values.

Ripple and The

Cross Border Payments Market

In order to understand Ripples functional utility value, we

must examine the cross-border payments market, and how Ripple can and will be

used as a means to serve that market.

Cryptocurrencies are an efficient means to move money

between countries and bypass governmental regulation and red-tape. This is

probably best illustrated by example – and so we begin by discussing the case

of Bitcoin and Chinese Capital controls.

In the past several years, there has been a growing fear

amongst many that the native Chinese currency, the Renminbi (also referred to

as Yuan), is overvalued and due for a significant move lower versus other world

currencies (the US dollar in particular). For various reasons, the Chinese

government doesn’t want this to happen (at least not abruptly) and so has taken

multiple steps to prevent it from happening. One of these steps is the

institution of ‘capital controls’ – rules and regulations that make it

difficult for Chinese citizens to move their Yuan denominated wealth out of the

country and into other currencies. This has put both individual Chinese

citizens and the Chinese government at odds with each other.

While the Chinese government can prevent citizens from

transferring money abroad through the official banking system (no Chinese bank

would dare defy an order from the government), they have been relatively

powerless to prevent citizens from moving money out of China through Bitcoin. A

simple example might be a Chinese local purchasing Bitcoin in China and paying

for it with Yuan. That Chinese citizen then boards a flight from Beijing to New

York, carrying their Bitcoin wallet private key on a slip of paper in their

pocket. Once they land in New York, they might arrange to meet a Bitcoin buyer

in a coffee shop, whereby in exchange for US dollars, they transfer their

Bitcoin.

There are however, problems and costs with this. First and

foremost, the Chinese citizen in our example may be (in the eyes of the Chinese

government) breaking the law – potentially exposing himself to liability should

he be caught. Furthermore, until the Chinese citizen in our example sells his

Bitcoin for US $, he is exposed to the volatility of BTC. Depending on how he

transacts, he also may be paying significant fees.

Nevertheless, the example demonstrates how crypto-currencies

(in this case Bitcoin) can be used as an ‘intermediary-currency’ to move money

around the world. Note that in this situation, Bitcoin is not being used as ‘money’ in a traditional sense, but as a specific

tool for transferring money and bypassing regulation. This is an example of the

functional-utility to which I earlier referred. Bitcoin (and all

cryptocurrencies to an extent) may have a functional-utility in the form of

money transfers – but is this the best way they may be used for that purpose?

And just how do we value this

functional utility?

And so, without further ado, we come to Ripple and the

(legitimate and legal) Cross-Border payments market.

According to McKinsey & Company’s 2015 report, the 2014

size of the annual (legal) B2B cross-border payments market was $155 Trillion.[4]

Assuming a modest 5% CAGR, we may estimate the 2020 B2B cross-border payments

market at $207 Trillion. Regardless of what your personal opinion is of ‘banks’

in general, it’s worth noting that all

of these transfers were presumably done through

banks. Philosophical and moral imperatives aside, from a purely practical

perspective, it’s where the money is.

Unfortunately, as even a short google search will demonstrate, transferring

money cross-borders is currently very complex, time-consuming (it can take

several days to clear), and expensive.

But like in our example with Cryptocurrencies, it should be easy. All you would need to do

to move money from Country-1/Currency-A to Country-2/Currency-B would be to buy

a cryptocurrency in Country-1 using Currency-A, and then turn around and sell

that same crypto-currency in Country-2 for

Currency B! As long as you have bank accounts on both sides set up and agreeing

to the legitimacy and legality of the transactions, you could do this relatively

quickly and easily.

So what would you need to do this?

Well, first and foremost, you need the banks to sign on to it and invest their own resources

to adopt it. Since all of that $200+ trillion moves through business bank

accounts, the banks will need to have the regulatory, legal, and logistical

systems set-up before they can adopt the system. This is no small thing to get

the banks to do, but of course the payoff for them to get it right is huge.

Once the system is working, the participating banks can do away with their

current slow and expensive cross-border-payments protocols and generate

significant operational savings as well as market new, better services to their

clients.

The fact that Ripple appears to have demonstrated such

significant early success in signing up banks bodes well for their continued

success, as first mover advantage in getting banks to adopt such a system is likely

to be key. This is because:

a)

The more banks you have on board (as part of

your cross-border money transfer community), the easier it is to convince other banks to sign up. Not only does it

become an ‘easier sell’ internally at banks to adopt something new (if other

reputable banks have already done so), but the very fact that other banks are

already signed up means you (as a new member) will have all of those other banks as potential counterparties to engage in

your future transactions.

b)

Switching costs are likely to be relatively

high. Even if a ‘newer, better, faster’ crypto-currency solution comes out

tomorrow, it is unlikely that any of the banks who signed up for Ripple will be

keen to scrap all their legal, operational, and system integration work in

favor of trying again with someone else and starting over.[5]

The Numbers

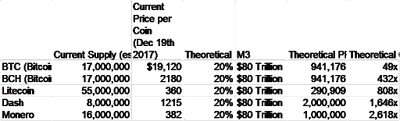

We start with our 2020 estimate of global B2B cross-border

money transfers of $207 trillion.

Let’s assume (just to begin with) that Ripple accounts for

100% of this volume. Let’s further assume that this volume of transfers is

evenly distributed amongst the days of the year, so daily transactions are

valued at $207 trillion / 365 days = $567 billion… or for the sake of round

numbers - $600 billion.

Now if $600 billion of money value is transferred through

Ripple each day, some significant portion of that total must exist in the form of Ripple dedicated to effecting these

foreign exchange transactions. To demonstrate this, let’s assume that this

dollar amount is done in one, single transaction (and then we’ll adjust to come

closer to a more realistic viewpoint).

In this theoretical example, we assume American Bank A wants

to send $US 600 billion to Chinese Bank B, where it should ultimately ‘arrive’

as the Remnibi equivalent value of 4 trillion Yuan[6].

In such a case, American Bank A must buy

$600 billion worth of Ripple, which it then sends over the Chinese Bank B who then

sells this quantity of Ripple in

exchange for 4 trillion Yuan. We can see that in order for this to work, there

has to be an existing pool of Ripple (and Ripple/currency traders) worth at

least $600 billion.

Now of course our $600 billion of daily transactions

wouldn’t be done in one single transaction. It wound instead be done in many

thousands of transactions. But the minimum value of the Ripple needed ‘to

exist’ in order to effect these transactions though isn’t so much dependent on

the quantity of transactions, but rather:

a)

the frequency of transactions and how long they

‘live within the ripple for’

b)

how many Ripple/Currency pairs are traded (in

this case, Ripple vs USD, and Ripple vs Yuan)

c)

how many independent dealers are involved in the

Ripple-related foreign exchange market

When taking into consideration the prospective details of

all these transactions and my own personal experience dealing with trading

markets and ‘dealer inventories’, I believe it’s a reasonable assumption that 35%

of the ‘average daily volume’ calculated above would be held in the form of

‘working capital/trading inventory’ by all market-making parties. This takes

into account an average ‘inventory turn’ of 3+x a day, as well as a recognition

of the need for many disparate individual dealers to hold excess inventory to

account for intraday demand spikes.

In such a case then, the average ‘inventory hold’ of all

Ripple dealers (those facilitating foreign exchange transactions with the

banks) would be 35% x $600 billion or $210 billion.

Said another way, under this circumstance a mere $210

billion of inventory would be enough to support annual transactions of $207

trillion – a mere 1/1000th of the gross annual volumes.

But this is assuming that Ripple accounts for 100% of all

B2B cross-border transactions which is unrealistic. Let’s instead assume that

Ripple has garnered a 35% market share by 2020[7].

This would mean that the ‘dealer inventory value’ of all Ripple would need to

be no less than 35% x $210 billion or $73.5 billion.

But we must now adjust for the fact that dealers are not going to be holding all of the Ripple in circulation[8].

Given the presence of investors, speculators and consumer users of this

technology, we might expect the dealers to only account for 80% of the extant

Ripple coins in circulation. But the fact that the dealers don’t own 100% of

the coins in circulation does not

change the fact that the total amount

of their inventory must be no less than $73.5 billion to effect their

transactions. Therefore, we can estimate

the total value of Ripple in

circulation (when taking into account the 20% held by investors, speculators

and consumers) to be $73.5 billion / 80% = $91.9 billion. This is then our

solution as to what the functional utility floor

value is for total circulating Ripple in 2020, if our assumptions prove

correct. The only thing left to be determined then is how many XRP will be

outstanding for this value to distributing over?

Considering that:

a)

there are currently less than 40 billion XRP

outstanding

b)

it is neither in Ripple’s self-interest nor is

it consistent with the lockups that have been announced for a substantial

amount of XRP to ‘flood’ the market,

I believe a reasonable estimate for XRP outstanding in 2020 to

be no more than 65 billion. Therefore, the value of each single XRP would be

$91.9 billion divided by 65 billion or $1.43 per XRP or approximately 7x

current trading values. From a present value perspective, If we assume a 20%

discount rate for 3 years, we arrive at ~$0.83/XRP, or a nearly 4x

multiple to where it is currently trading.[9]

If Ripple is successful in establishing itself as the

dominant leader in B2B international money transfers, and/or the distribution

of XRP/Foreign-Currency traders requires higher ‘dealer inventory holds’, then

the value would of course be significantly higher. For example, if Ripple

garners 70% of the market (as opposed to our 35%) and the total dealer hold is

50% of forecast daily transactions, then the valuation yields a result nearly

triple what we’ve calculated so far.

Furthermore, remember though that this exercise is simply

about demonstrating the functional-utility floor

value of XRP. If/as the usefulness of XRP in the cross-border payments

market is demonstrated, it stands to reason that a significant portion of the

investing/speculating population will see XRP as potentially worthy of being

considered ‘money’ in its own right. That XRP requires no mining resources as

Proof-Of-Work coins do, is likely to have a leg-up in becoming integrated with

the ‘everyman’s bank account’, and offers transaction processing speeds of 5-10

seconds argues for potentially significant and widespread adoption (and

subsequent value appreciation).

Follow @cryptoizzy

[1] In

my experience, the frequent mark of a good idea is that it quickly becomes part

of conventional wisdom – so much so that people wonder how it could be that ‘no

one thought of it before’.

[2] The

currency is typically also accepted as the exclusive

means with which to discharge economic obligations. If you don’t believe this

to be so, try paying your US taxes in Euros.

[3] I

recognize that a currency’s use ‘as money’ is technically its own form of

functional utility. For the sake of this paper though, I define the term

functional utility as excluding traditional money-uses such as being a generalized medium of exchange, unit of

account and store of value.

[4]“Global

payments 2015: A healthy industry confronts disruption” – by McKinsey and Co.

[5]

It’s for these reasons that I am skeptical of Stellar’s competing platform.

They appear to be at a disadvantage relative to Ripple in signing up banks, who

are the largest near-intermediate term users of the service. That there is

quite a bit of ‘soap-opera’ drama behind the founding of Stellar doesn’t help

in that regard. Banks generally would prefer to choose a known and stable

quantity over a brilliant but potentially volatile option. And while Stellar

seems to be trying to market itself more as a libertarian option ‘away from the

banks’, I question both the authenticity of their approach as well as the

ultimate efficacy of adoption.

[6] We

assume a CNY/USD exchange rate of approximately 7:1.

[7]

Depending on your perspective, this may seem aggressive (considering the

newness of the technology) or conservative (considering the cost and process

advantages of the system, as well as potentially exponential adoption rates).

[8]

Note also that for this exercise the ultimate

‘diluted’ total amount of XRP in the

system is not relevant, but rather the outstanding

float, as it is only the

outstanding float that may be used for the functional purpose of these

transactions.

[9]

Why a 20% discount rate? Considering both the speculative enthusiasm of the

crypto-market, exceedingly low nominal interest rates (thanks central banks),

and the real-progress the Ripple organization has made, 20% seems like a

reasonable level at which the market may settle.