Valuing Cryptocurrencies - An Approach

Valuing Cryptocurrencies - An Approach

There are well over 1,000 cryptocurrencies floating around

right now, and it’s my sincere belief that many, if not most of them, will

fail. This becomes especially evident when a little bit of thoughtful research

is done, and one sees that many of them either have no realistic plans for

success (beyond a pump-and-dump of the coin), and/or offer no meaningful value

that is not already well represented in the crypto-space. So how to tell them apart? Well, I’ll share

my personal approach, which I hope you find interesting and maybe useful. I

suspect that applying this methodology might lead one to ‘miss out’ on some

rip-roaring rally on a coin that might otherwise have been speculated in, but

hopefully it will also keep one from waking up one morning to discover the coin

thought to be a sure thing for a quick in-and-out trade has dropped

precipitously in value. Different people need different things to sleep at

night. Diff'rent strokes for Diff'rent folks.

Step 1: Ask

(and attempt to answer the question) – Is the goal of this cryptocurrency to be considered money? In other words,

does the coin hope to be considered a broad and fundamental unit of money/currency that will be used to effect

value transfers?

The primary examples of coins that attempt to ‘be money’

are:

Bitcoin, Bitcoin cash, Litecoin, Dash & Monero.

The goal of eventually becoming money is potentially incredibly valuable. The prize is the

displacement of a significant percentage of existing forms of money (namely,

Fiat currencies issued by governments, whether they be dollars, euros, yen,

etc.) and that achievement would be stupendous in its implications – both

socially and financially.

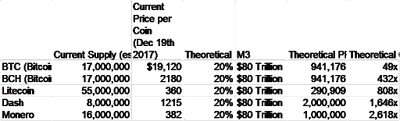

The current measure of all transactional ‘money’ in the

world (an economic measure called M3) is approximately $80 trillion. If any one

of the 5 coins above mentioned are to be successful as ‘money’ and garner a

significant share of M3, it would have astounding implications for the value of

the coins. The (very rough) table below shows that ‘upside’ from current values

should the individual coins achieve a 20% of M3 ‘market share’ range from ~50

times current value for Bitcoin, to over 2,600 times current value for Monero.

This is in stark contrast to coins that do not

aspire to be money which we will explore shortly.

(Please excuse the horrendously scrappy cut/paste for the

below table.. the gist of it should be clear though)

So now we come to a fork in the road – was the answer to

Step 1 a ‘yes’, or a ‘no’? If ‘yes’, then proceed to Step 2. If ‘no’, proceed

to Step 3.

Step 2: Check

the coin under consideration for its current and prospective ability to satisfy

the criteria of ‘moneyness’.

I won’t go into a full re-hash of the concept of moneyness

here, as you can read plenty about it in TPOM and The Bitcoin Flaw, but in short,

the coins need to satisfy the 4 main aspects of sound money – Store of Value,

Unit of Account Medium of Exchange and Fungibility[1].

We check for its moneyness under the simple premise that if

a coin lacks any critical aspect of

moneyness, it will ultimately fail and hand the mantle of ‘money’ over to a

coin that succeeds. My take on all the above mentioned coins (in case you didn't know) is that i far prefer Monero as the best candidate. In any case, you can decide for yourself and are free to disagree

and/or hedge your bets.

The math though for valuation in this scenario becomes

trivial (although determination of input values is not). If the coin in

question passes the test for being surviving money, then we may apply the

valuation technique as {[Expected % of M3] x [M3 Value] }/ [number of coins

outstanding].. all present-valued.

Step 3:

Determine what value is being created by the coin and/or coin ecosystem.

*Note: you should only be here in step 3 if you answered no

to the question in Step 1. I realize that some people might make an argument

for ETH being in both places, but I disagree for reasons I won’t expand on

here. Feel free to email me if you’d like to discuss.

Since the coin we are now looking at is not a ‘money’ prospect, we can apply much more traditional valuation

metrics – without needing to understand some bigger-picture and subtler aspects

of global macroeconomics. Hooray!

We simply need to ask, what value is being created?

Let’s take what has been a contentious coin for me as an

example: Ripple (technically XRP, the coin).

Ripple, as a medium of exchange that can facilitate lower

cost cross-border transactions, offers the prospect for enormous value to be

released. After all, there are many billions of dollars currently spent (and

arguably wasted) in the current archaic and cumbersome international money

transfer market. We can even ascribe theoretical dollars to it, so let’s do that:

Let’s say the Annual cross-border international transfer

market is $200 trillion annually, and let’s further assume the average fee

savings by replacing the old archaic systems with the disruption of blockchain-type

processes will be a clean 5% - that’s $10 trillion a year!

So maybe this mean that Ripple’s coin, XRP, if Ripple were

to garner a 100% market share should be worth $10 trillion?! Not so fast there

cowboy.

Now that we’ve identified the potential value-creation/release

aspect, we need to make a critical

next-step jump – and this leads us to Step 4. Of course, if we haven’t been

able to identify any monetary value

being created at all, we can stop here and most likely abandon the coin from

consideration.

Step 4: Ask –

To WHERE and/or WHOM does the value created in Step 3 Accrue?

In Ripple’s case, most of the value accrues to two parties –

competitive pressures will see to that – either the banks themselves who no

longer have to bear the cost-burden of an antiquated system, or the customers who will experience much lower

costs and fees.

But wait a minute – we are valuing a coin here – so the real question (between the lines) is something a

little different.. let’s make this our step 5.

Step 5: Ask –

How does value created by the coin/ecosystem/etc. necessarily accrue to the coin

under question? And by how much?

Let’s stick with Ripple for the example.

I’ve never argued that Ripple wasn’t a good idea. While I still

question the uptake and competitive response, and many people have enjoyed an ‘I

told you so!’ after a few recent announcements and a big price move – I have

yet to hear anyone address this Step 5 question (even though it has been asked

of some people who claim to be the experts).

Just because a coin/currency/etc. creates value as a whole,

for an investment in the coin to be

based on solid fundamentals, there has to be a demonstration as to why the coin

needs to be worth more.

Good news for XRP investors – I definitely see a scenario

where it needs to maintain a value. The (potentially) bad news – that value could

be a lot lower than current levels.

Rather than rewrite it, I’ll just quote my other post (the

Postscript to ‘Goodbye to Ripple’… even leaving in my 2-glasses-of-wine snarky

comment):

Most people (not

all) have conceded that Ripple is not about

being ‘money’, but a functional tool. In that case, we ought to value it on

that metric – how much value is being created, and to where does it accrue?

Let’s use some

numbers.

$207 trillion

annual market size.

Assume evenly

distributed, that’s about $500 billion moving a day.

There are 86,400

seconds in a day. Again, assuming smooth distribution if XRP was 100% used as

transfer medium in the market, every 5 seconds (on average) it would have to

move about $30 million. If we assume it needs that FULL balance to be held in

15 different currencies, that’s a required market float of 30million x 15 =

$450 MILLION (that’s million with an M). Heck – let’s say that we’re off by an

order or magnitude somehow and multiply by 10. Now we’re back to billions - $4.5

billion – or less than half the current capitalization.

Is there a fault in

that example? I honestly don’t know. I just spent 5 minutes working it out and

have had a couple of glasses of wine. My point is, talking about value

being created and that same value accruing

to the benefit of the actual coins is talking about two very different

things. It’s the same thing as a company you might love, but whose stock is

awfully priced.

While people may love-love-love XRP as a trade right now, if

it is going to maintain its value, it has to be demonstrated in theory perhaps, but ultimately in practice

why it needs to be valued more than,

for instance the $4.5 billion in my example above. Otherwise its value is being

propped up by raw speculation - not buttressed by any fundamental value. This

in turn leaves it subject to significant (and perhaps inevitable) correction risk.

I didn’t really want this to be about Ripple, so I’ll just

add one more thing before moving on – in the cryptomania we’re seeing today,

going up in value is not proof that a fundamental valuation is sound. Maybe

there are other fundamental justifications for why XRP needs to be valued where it is (outside of a speculation medium).

If there is/are, I have yet to see it/them. If you genuinely see a way to correct

me, then by all means, don’t waste time leaving Anonymous blog comments – send it

to me and convince me. I guarantee I’ll issue an ‘eating my hat’ mea-culpa report

highlighting the error(s) in my (now current) thinking.

So – back to how value accrues to a coin in general.

If you cannot identify how value must accrue to a coin (whether as a function of facilitating a

smart-contract, money transfer, or otherwise) then you are very likely veering

away from investing and toward speculation.

Hey, there’s nothing wrong with gambling/speculation per se.

I’ve personally never been really good at it. Some people are. But before you

convince yourself that you are blessed with innate intuitive trading sense,

consider this: All those glorious and impressive Las Vegas hotels and monuments

were paid for by losers – and though I’ve

personally known a few paper-millionaires in the dot-com boom, each of them quietly

went back to their day jobs a few years later.

As the saying goes: Bulls make money. Bears make money. Pigs

get slaughtered.

Good luck!

Izzy

EDIT: March 2018: if you've read up until this point, then hopefully you have enjoyed it. Considering how many hits this page gets, i thought i would mention that if you are interested in engaging me for cryptocurrency education or advisory, please feel free to email me. I've always happy to have a chat.

[1] Technically speaking fungibility really falls under the purview of Medium of

Exchange. I’m happy to leave it as a 4th criterion though given it’s incredible

importance and difficulty of grasp for many, which I think may be remedied by

calling extra attention to it.

Thanks for sharing...

ReplyDeleteYou might have a doubt that why should you use Bitcoin to make and receive payments rather than using paper currency for transactions. Well, there are many benefits that you can enjoy if you start using Bitcoin. Now there might be some Ganesh Godse but he was the man with all positive energy and dynamic personality.

Earn Bitcoins while using Google Chrome. Add CryptoTab to your Chrome and start earning Bitcoins. Get CryptoTab - Easy way for Bitcoin Mining. Develop the network and get your rewards! Invite your friends, family and associates by your personal link and make many times more money! Get more than 1 BTC!

ReplyDeleteGreat read! Follow daily cryptocurrency trends and news and make profit

ReplyDeleteNice post! Live Active ICO 2018That is an extremely nice blog that I will definitively come back to more times this season! ICO List 2018 Thanks a lot for the informative post. Active ICO 2018

ReplyDeleteEthereumpro.net provides cheapest way to convert ether to paypal usd where any one can withdraw and transfer crypto coins ethereum to paypal with no minimum amount required

ReplyDeleteSystem works automatic with high speed.

Follow the link below:

https://www.ethereumpro.net/exchange-ethereum-to-paypal.php

Exchange ethereum to paypal instantly

ReplyDeleteethereumpro.net best website to exchange your ethereum to paypal and other currencies.there are many websites are working but this is the

best website.highly trusted site and have thousands of satisfied customers

https://www.ethereumpro.net/

The visit our website in a secure website and not charging any fee. It is the best source of exchanging your ether because it provides best market rates for the selling and converting of ether into paypal. This is an automatic website and complete the whole process with in minutes and saves time of clients. It will provide the detail analysis of the current and historical prices of Ethereum to the users for their profitable decision making.

ReplyDeleteCodeninja.pk is web development company in lahore,Allow potential clients to understand your strengths.Establish yourself as a leader within the industry.

ReplyDelete

ReplyDeleteآهنگ های محسن چاوشی

آهنگ های آرون افشار

دانلود آهنگ انگیزشی

آهنگ های پرطرفدار جدید

آهنگ تولد ترکی

ریمیکس شاد ترکیه ای رادیو جوان

دانلود آهنگ سالگرد ازدواج

دانلود آهنگ های شاد تالار عروسی

One of the most convenient places to purchase XRP is online. There are many places that you can go to buy XRP and other digital assets such as stocks, bonds, and options.

ReplyDeleteMany people are wondering if it is safe to use a service such as the Silkroad or Bitcoin exchange to conduct their trades on the web.

ReplyDelete👊 $FIGHTCLUB Token 👊

ReplyDelete✔️ - it is 100% community led

✔️ - no presale, no private sale

✔️ - no fancy launch party

✅ 90% LP Burnt 🔥

✅50% Supply Burnt 🔥

✅Contract Ownership Renounced

🛡 100% Unruggable 🛡

💥500 tokens max per transaction to help against sudden price changes💥

📌 Contract Address:

0xce1040c432EbD6a018aa7ca81aC9a23c6aBF69E4

📌 Buy link:

https://exchange.pancakeswap.finance/#/swap?outputCurrency=0xce1040c432EbD6a018aa7ca81aC9a23c6aBF69E4

(Set slippage to 1%-11%)

Website: https://www.fightclubtoken.com

🗣Telegram: https://t.me/Fightclubtoken

Twitter: https://twitter.com/fightclubtoken

IDO: Initial #Dex Offering

ReplyDeleteBuy new #tokens with a brand new token sale model.

1% of the raised amount is used to buyback and burn SALT or contribute to a new Ocean

Buy Now: https://www.saltswap.finance/ido

#Ozone #Finance, The best Yield Farms for all earthlings on Binance Smart Chain.

Upgrading Ozone Finance to Polygon Network with No-Loss Lottery, #NFT, and Layered Farming.

Defi Url : https://Ozone.Finance

Twitter: https://twitter.com/OzoneFinance

Medium:https://Ozonefinance.medium.com

Telegram Group Chat: https://t.me/OzoneFinanceChat

Telegram Channel: https://t.me/OzoneFinanceAnnouncements

The AvocadoPunks are 3,333 unique collectible ERC-721 Non-Fungible Tokens (NFTs).

ReplyDeleteThere will never be more than 3,333.

Visit: https://avocadopunks.web.app/

OpenSea: https://opensea.io/collection/avocadopunks

Twitter: https://twitter.com/avocadopunks

#nft #nfts #OpenSea #avocadopunks #art #arttoken #punks #nftpunks

Moonsafe is a 100% decentralized community project

ReplyDeleteThat gives to the holders a passive income and increase the liquidity through RFI and LIQ protocols.

Moonsafe is the first community on BSC to support its investors by giving them the right to improve the project through community discussion. Moonsafe charges 8% for every tx and gives 4% back to all its holders, a passive income to reward them, so diamond hands can accumulate simply by holding. It transfers the other 4% to the liquidity pool, to ensafe the community investment and stabilize price movement while the Floor Price automatically increases.

Unruggable

Liquidity is locked in Pancakeswap, LP are burned. No team token, no mint function = rugproof

100% Decentralised

No team allocation at launch means that MOONSAFE is 100% community led.

50% SUPPLY BURNT

50% of the supply has been burnt at launch.

Small Raise

A small presale to allow a good stability for the pool was raised

From our Telegram:

������M O O N S A F E������

�� An undiscovered gem ��

✅ Time tested: community revived token ��

✅ Can not be rugged: ownership is transferred to burn address ��

✅ Liquidity locked forever ��

✅ 4% fee redistributed to holders and 4% fee added to LP

✅ Low marketcap with CG listing imminent⏳

�� Contract address:0x2C125b09C2DBed3d1669a3183298285e5cf46154

�� TG: @moonsafeofficial

�� Price bot: @unirocket_moonsafe

�� Website: https://moonsafe.xyz

There is also some details for finding the coin:

✔️LP burned:

https://bscscan.com/tx/0x495ad4cbc35482f1e49013da68e18df15a81e662710080f8c3cc6ac5cbefe63c

�� Chart : https://poocoin.xyz/tokens/0x2C125b09C2DBed3d1669a3183298285e5cf46154

�� Price Bot : @unirocket_moonsafe

�� BUY HERE (��SLIPPAGE 8-12%, NO DECIMALS):

https://exchange.pancakeswap.finance/#/swap?inputCurrency=0x2C125b09C2DBed3d1669a3183298285e5cf46154

Top1Swap.Finance The New generation #YieldFarm #Staking #Casino #Nft #IFO #Lottery #slots #Swap on#BinanceSmartChain #BSC $BNB #Top1Swap

ReplyDeleteTelegram: http://t.me/Top1Swap

Website : https://www.Top1Swap.finance

Twitter : https://twitter.com/Top1Swap

Medium : https://Top1Swap.medium.com/

Horizon Defi - the number one ido launchpad and passive income, staking and more, insane team behind this project

ReplyDeleteAMA - https://youtu.be/vroOE4JJHyk

Horizon- A New IDO platform in the making, created to revolutionise Initial Dex Offerings.

Our plan is to have the UI up and running out of beta by the 20th of April

Earn a passive income with 5% of all transfer fees split between all holders

Link to Telegram : @riskhorizon

Meet the CEOs (the ones who have doxxed identity):

Diogenes Casares: https://www.linkedin.com/in/diogenes-casares-aa3381130/?locale=en_US

Ethan Marcus:

http://linkedin.com/in/ethan-marcus-633811194

Buy $Horizon: https://exchange.pancakeswap.finance/#/swap?inputCurrency=0xFF13b4aaA61C3a4C257A754d259f91A6f34Bf899

Chart: https://poocoin.app/tokens/0xFF13b4aaA61C3a4C257A754d259f91A6f34Bf899

Liquidity locked via Dxsale for 5 years:

https://dxsale.app/app/pages/dxlockview?id=191&add=0&type=lpdefi&chain=BSC

Website/App (Still in beta stages):

https://defihorizon.app/

$WON is the 1st Smart Contract with a lottery.

ReplyDelete📈WON automatically distributes:

💸 7% of a current transaction value to a lucky token holder.

💎1% of the transactions is paid to holders.

💎1% of the transactions is automatically added to liquidity on PancakeSwap forever.

TOKEN METRICS:

Total supply: 1,000,000,000,000

1% Burn

1% Farm

7% Lottery

✅NO PRESALE. FAIR LAUNCHED ON PANCAKESWAP

https://exchange.pancakeswap.finance/#/swap?outputCurrency=0x17dda4de32d5d5a43053703e503230953346c7ed

Website: https://won.finance/

Twitter: https://twitter.com/wonfinance?s=20

Telegram: https://t.co/uZlGYPwgjc?amp=1

Bscscan: https://bscscan.com/token/0x17dda4de32d5d5a43053703e503230953346c7ed

Cryptocurrency with the purpose of planting trees all over EARTH Working Towards a Brighter Future One Tree At a Time 90% of the total supply burned, The remaining tokens locked on pancakeswap. We are ensuring a fair and completely decentralized distribution

ReplyDeleteWebsite: https://www.saveearthtoken.com/

Buy From:

https://exchange.pancakeswap.finance/#/swap?outputCurrency=0x497c035d5b04773228a4e923fe58c795fec3c127

Telegram: http://t.me/saveearthtokenn

#Cryptocurrency #tokens #pancakeswap #decentralized #NFT #nfts

$GROOOT is a decentralized BSC community token that plants trees with every transaction! 🌳

ReplyDeleteLiquidity locked and team is doxxed!

They have a unique donation mechanism with a tree wallet that allows to efficiently plant trees to give back to the environment.

GROOOT has already planted 27k+ trees with a market cap of only 70k! 🌱

Whitepaper and donations on the website:

https://wearegrooot.finance/

Join the community:

https://t.me/WeAreGroootFinance

#BSC #TOKEN #ICO #GROOOT #NFT #NFTs

HORNYFARM is an NSFW themed farm on the BSC with strong deflationary mechanics, sustainable high APY and…. stress-relieving NFT rewards

ReplyDeleteThe aim of HORNYFARM is to create a rather mature token farm that caters towards our investor’s true needs… their wallet and their “soul”…

The primary token HORNY will provide a long-lasting price pump, with our climaxing burn mechanism you’ll be trying the try not to dump challenge.

Holders of HORNY will have a chance of receiving unique stress-relieving NFTs. 5 NFTs will be dropped daily to 5 random holders, the more HORNY tokens you hold the higher chance of receiving a higher quality NFT

Website: https://hornyfarm.xyz/

Telegram: https://t.me/HORNYFARMCHAT

Twitter: https://twitter.com/HornyFarm

Welcome to Mooni DeFi, we are on a journey to build spectacular products for the community, where the we want to reward the community by being one of the lego box of DeFi on Binance Smart Chain.

ReplyDeleteMooni DeFi is the incubator based on Binance Smart chain with innovative product launches, where community gets rewarded in ecosystem tokens.

Our focus is to build innovative DeFi products for BSC and support fair launches for the community. The ecosystem consists of four main offerings initially, here are the products with launch dates.

Mooni Token : Mooni token of Mooni deFi ecosystem, holding Mooni will give users voting rights for the development of ecosystem, also when you trade, each transaction has a 5% fee applied, which will be redistributed instantly to all holders of the Mooni token. The great thing about this mechanism is that holders will be earning rewards without staking or any interaction with smart contract. Mooni is also a governance plus utility token, using which the community can exercise rights on development of projects from our ecosystem.

To Know More visit : https://moonidefi.xyz/

Join the largest DeFi ICO in 2021!

ReplyDeleteDeFi Payment Protocol that enables POS terminals on blockchains and brings consumer protection to crypto payments.

Join Here : https://merchanttoken.org/?ref=CQ5NNP8C4

Initially scheduled for 90 days. Almost sold out half after only 9 days. Your chance to be part of it!

The ICO will progress for a total of 100 phases. Each phase collects $250K and for each phase the token price will increase $0.01 until it reaches $1.20 at the end of the ICO in July.

Rocket tokenomics: only 100M total supply.

HIPS Merchant Protocol (HMP), the Hips Merchant Protocol Gateway (HMP- gateway) and the governing Merchant Token (MTO) is a solution that aims to introduce consumer protection concepts from the traditional card payment industry to any blockchain with support for smart contracts like Ethereum, Cardano (ADA), or Solana.

We believe that the consumer-oriented features of the MTO are the missing piece for crypto payments to have a market penetration and mass-adoption among mainstream consumers," says John Cavebring, CEO of Hips.

Merchant Token (MTO) is Hips Merchant Protocol's (HMP) native protocol token, currently issued on Ethereum following ERC-20 standard. HMP will escrow ERC20 tokens in Ethereum’s blockchain as a start, but the protocol will work similarly on other supported blockchains such as Cardano among others.

“HIPS Merchant Blockchain is the native blockchain for HMP and Merchant Coin (MEO), which is the on-block native currency on the Hips Merchant Blockchain, and is optimised for real-time merchant transactions created for Payment Service Providers (PSP) and EFTPOS devices,” adds Cavebring.

A widely adopted, completely on-chain Merchant Payment Protocol would need to have comparable transaction throughput like US exchanges such as the NYSE from an underlying blockchain in order to scale.

“HIPS Merchant Blockchain’s near real-time transaction speeds are a vast improvement to the current blockchain response. Hips Merchant Protocol is not only built for Ethereum, but also on Solana, a blazingly fast public blockchain which can support over 50,000 transactions per second, has block times of 400 milliseconds and a transaction cost of roughly USD0.00001,” notes Cavebring.

ENEDEX: The first Polkadot Moonbeam crosschain DEX for energy trading providing an easy way to kickstart new projects and raise capital

ReplyDelete�� The ENEDEX Private Sale has now officially started. ��

��Pledgers will need to visit the ENEDEX.org ( https://enedex.org/ ) website, and click on the ‘Private Sale’ tab to fill in the Private Sale Form.

�� Please fill in full and a member of our team will follow up to complete the KYC.

Join now, and be part of the Energy Trading revolution!

Catch more of our stories in our channels below:

�� Twitter: https://twitter.com/ENEDEX_HQ

�� Medium: https://enedex.medium.com

�� Telegram: https://t.me/ENEDEX_Official

�� Telegram Announcements: https://t.me/ENEDEX_ANN

"Mona Lisa Landscape Nft"

ReplyDeleteTo Place A Bid on Opensea Click Here

We have designed digital art based on unique pieces of great historical and artistic value to create something exceptional. The paintings themselves could be a beautiful work of art that incorporates years of research, manual reconstruction procedures, and the latest technology.

Crypto Gaming Alliance begins CGA Coin’s free sale.

ReplyDeleteCGA that has successfully completed its first private sales is carrying out CGA Coin free sales with limit quantity with promoting exchange market ahead.

More info: https://www.cgagames.org/

LunaWorld is a community driven and fairly launched token on the Binance Smart Chain focused on Security and Long-Term Growth

ReplyDeleteDxSale Pre-Sale live now, link below:

https://dxsale.app/app/pages/defipresale?saleID=1326&chain=BSC

Token contract:

https://bscscan.com/token/0xb69ac237ad38ae7ff603423adbfbd6b81c00aeaa

Economics of LunaWorld:

✅ Total Supply: 1,000,000,000,000,000

✅ Presale Supply: 500,000,000,000,000

✅ Listing Pancakeswap: 400,000,000,000,000

✅ 5% Distributed to Holders

✅ 5% Added to Liquidity Pool

Website: https://lunaworld.io/

Telegram: https://t.me/lunaworldofficial

Github: https://github.com/lunaworldbsc/lunaworld/blob/main/LunaWorld.sol

#Hadron

ReplyDeleteThe decentralized deep #learning platform for next-generation #AiApps.

A.I. is poised to become one of the most powerful forces in our civilization, and has been compared to the discovery of fire.

Hadron is designed to level the playing field and make A.I. accessible to everyday people via user-friendly AiApps. These apps run on our protocol and token to allow people, regardless of class, creed, or ethnicity, to experience the benefits of distributed machine learning.

To know more register on the https://hadron.cloud

Using the referral email address as (Activate@engineer.com)

Project podcast: https://open.spotify.com/show/5c0uCrC8CLEJTS682DS2x6

In 1969, we landed on the moon for the first time. We saw images of an astronaut, a space craft, and an American flag. In 2021, we have the Dogecoin landing. Instead of an astronaut, a space craft, and an American flag, we have Elon Musk, a Cybertruck, and a Dogecoin flag. We are living in the future, commemorate this world changing moment with one of only 69 Dogelanding collectible cards.

ReplyDeleteBuy now : From Rarible

🚀 Join the largest DeFi ICO in 2021 🚀

ReplyDeleteMerchant Token raises $25M in #ICO with 100 rounds

🔴LIVE NOW

LAST CHANCE TO GET IN EARLY

#Rocket #Tokenomics: only 100M total supply

Big Money involved if this globally hits the world of Commerce!

This might well be the #moonshot of 2021!

https://merchanttoken.org?ref=CQ5NNP8C4

Fintech Finance Virtual Arena interview:

https://youtu.be/PB1IntFszq0

USDX888 MMM system with advanced technology of cryotocurrency to transfer money and confirm transaction automatically.

ReplyDeleteStart now at: https://usdx888.com/

#defi #cryotocurrency #usdt #trx #cryptoexchange

High yields BSC farm brought by the Snakes.

ReplyDeleteEarn SNKE through yield, then stake it in Pools to earn more tokens!

Security first on Snake Defi

To know more Visit: https://www.snakedefi.com/

Join The PYE Nation Today and Become Part of the Movement

ReplyDeleteCreamPYE is looking to fully disrupt the decentralized world. We have put together a team behind the CreamPYE project to build better tech than what is currently available today. We are more than just a DeFi token, we are the future of Defi/Decentralization and CEXDEX. Join us for the ride of a lifetime and be a part of making a true impact in the world to help stop world hunger and at the same time disrupt the decentralized world by offering better tech and more affordable access to everyone.

To know more : http://www.creampye.com/

⚛️Tronpin ������

ReplyDeleteA revolutionary immutable community financial system ��built on #Tron smart contracts blockchain��. ��Verified contact ��and transparent protocol with clearly defined logic��, Tronpin is self-sustainable ��with a balance of gaming��, networking��, and investing��. Participants interact directly with #Tronpin smart contract�� & settlements happen in real-time ⏱with no central custodian��. With community built trustless system⚖️, you can play��♂️, network ��and earn ��with an ease of mind!

Visit: https://www.tronpin.com/

💎DCTDAO X Trustswap Marketing & Incubation Partnership💎

ReplyDeleteThe news you have all been waiting for is here. DCTDAO’s biggest partnership yet is launching to take the DCTD platform to new heights.

Trustswap will officially onboard DCTDAO onto its incubation platform, one of only a few projects ever to join, assisting with marketing, branding, product awareness and even technological development.

🎉 Wait there’s MORE, with the incubation also comes a partnership agreement to onboard and suggest all Trustswap IDO projects to list their tokens on the DCTDEX, cementing DCTDAO as the premier Gas-less, secure DEX for trading.

For more info about the incubation read on :

https://dctdao.medium.com/dctdao-joins-trustswap-incubator-program-90722f38bdff

EAT THE DIP FINANCE $EAT :chart_with_upwards_trend:

ReplyDeleteNew cryptocurrency meme today - just lunched.

38K MARKET CAP

LIQUIDITY LOCKED WITH UNICRYPT

RUG PROOF

FAIR LAUNCHED - NO PRESALE

TOKENOMICS

Total Supply: 857,375,000,000

35% burned

40% locked liquidity

10% Marketing

5% Team

Tax On Transactions

5% permanently burned

5% Redistribution

Visit: Https://www.eatthedip.finance

TG: @eatthedipfinance

Twitter: @eatthedip

Instagram: @eatthedipfinance

CHART

Https://poocoin.app/tokens/0x131daf4ee0c68962180a43713bcd3923c04d1820

CONTRACT ID

0x131daf4ee0c68962180a43713bcd3923c04d1820AVAILABLE NOW ON PANCAKE SWAP

Crypto Gaming Alliance begins CGA Coin’s free sale.

ReplyDeleteCGA that has successfully completed its first private sales is carrying out CGA Coin free sales with limit quantity with promoting exchange market ahead

More info : https://www.cgacoin.net/

The Magna Carter is a charter of liberties to which the English barons forced King John to give his assent in June 1215 at Runnymede. It is a document constituting a fundamental guarantee of rights and privileges.

ReplyDeleteMagna Carta is a BEP20 token with super high yield and liquidity generation tokenomics for the community. Magna Carta is created along with a purpose built forum No Rug Pull, which will provide this cryptocurrency with a purpose and use.

buy and sell cryptocurrency, Find safe moonshot projects, invest in rug proof mining pools, field farming and staking.

No Rug Pull forum will also enable users to exchange #MGN tokens for many crypto related digital good and services via Escrow payment.

As well as providing a decentralized exchange and a library of information for the growth of the community.

Name: Magna Carta

Symbol: MGN

Total Supply: 100,000,000,000,000

Certik - Audit coming Soon

Coin Gecko 🦎 & CMC Application

Contract address

0xF7C20bB6192d8469E67C858A5082AD55437F5eaD

10% Tax

2% burn 🔥 rate

8% community reward 💰

More info: https://magnacarta.finance/

Telegram: @magnacartatoken

Shiba Survived #BlackWednesday Animated NFT Lottery

ReplyDeleteJoin Here: https://gleam.io/xAmjL/shiba-survived-blackwednesday

The Animated NFT can be checked here:

https://www.bakeryswap.org/#/exchange/new-artworks/artworkInfo/24823/1/0

This NFT is extremely valuable due to its rarity and number of participants that will compete for it.

Only 1 piece of the Shiba Survived #BlackWednesday Animated NFT will ever be minted.

The winner will be contacted by email at the end of the contest. We will announce the winner of the lottery on livestream on 8. June 2021.

To know more about the project

visit: https://emcodex.org/

EgyptianDoge is a frictionless yield generation token hard-coded on its smart contract with a charity-based NFT marketplace.

ReplyDeleteBUY YDOGE ON PANCAKESWAP

More Info: https://cutt.ly/unONjTL

#EgyptianDoge #ico #exchange #token #nft #nfts #bnb #bsc #PANCAKESWAP

A community-focused decentralized transaction network

ReplyDeleteWe are a part of the newly emerging family!

Pekker is an Ethereum Token with a burn and redistribution system. 1.8% of each transaction is burned, and 0.2% is distributed as rewards to holders automatically and in real-time. Sit back, relax, and watch your Pekker balance grow every second!

To know more visit: https://www.pekker.org/

#ico #Pekker #Ethereum #Token #nft #nfts

Hi There,

ReplyDeleteThank you for sharing the knowledgeable blog with us I hope that you will post many more blog with us:-

CryptoSwap World is one of the first instant cryptocurrency exchanges to launch a Loyalty Program on the basis of a native token (SWAP).

Email:Cryptoswapworld@gmail.com

Click here for more information:- more info

D.AI.SY Opportunity

ReplyDeleteLearn about an exciting new crowdfunding project in the cryptocurrency space that smashed

every record ever made in the referral marketing and crowdfunding industry on day one!

● More than $150 Million dollars raised since launch

● More than 100,000 people in more than 100 countries contributed to the crowd fund

● The biggest financial technology development project in the world today

● Multiple income stream opportunity

This is YOUR opportunity to be part of history. Daisy is on track

to be a multi-billion dollar

project in 2021!

To join the program and learn more click on the following link

https://daisybiz.info/33596634

If you have any question or want to connect with me personally

you can contact me on:

Whatsapp

Australia +61 434352772

Telegram

@koalacryptogroup

Happy investing

Alex

Bittrex Global will list CRATOS on [Date], 2021

ReplyDeleteCRATOS is an ERC-20 utility token designed to facilitate citizen participation in the CRATOS app, a real-time live vote platform.

[Release date], 2021 – Bittrex Global, the major cryptocurrency exchange, announced it would list CRATOS(CRTS) on [listing date].

Bittrex Global said it would list CRATOS (CRTS) with a trading pair, CRTS/USDT. In addition, the users can start trading from [time] (UTC+8) on [date], 2021. This listing would be the Cratos’s third listing after BitGlobal(Formerly Bithumb Global) and Uniswap V3.

Cratos is an ERC-20 utility token designed to facilitate citizen participation in the Cratos app, a real-time live vote platform that anyone can generate a vote and users can participate in the vote immediately, and the statistics of the results by gender and age would be displayed to the users to enhance the transparency of public opinion. And users can earn CRTS tokens by registration, creating a vote, leaving a comment, and participating in a vote.

The Cratos app was designed to solve the issue that news by media and posts by online communities are biased. Sponsors of the media would have an influence on media to select the news that suits their taste. Online community users form a close community with like-minded people. With the transparency of the vote result, the Cratos will show the consensus of the public opinion. The Cratos tokens are given to the participants as a reward to promote their activities, which would lead to generating more accurate data.

Since its launch in December 2020, the Cratos app has achieved 220K+ downloads, 40K+ users, 17K+ vote items, and 15 mins or longer daily engagement time as of [release date]. 100 billion CRATOS tokens have been initially generated, and 36% of the initial supply has been allocated for rewards.

In 2022, Cratos is planning to expand its service to the global market.

About CRATOS

The CRATOS app is a real-time live vote platform launched in December 2020, and by far the app has accumulated 220K+ downloads, 40K+ users, and 17K+ vote items.

About Pharos Labs

Pharos Labs, registered in South Korea, is a blockchain-based company-builder to commercialize their business idea with blockchain technology and BasS(Blockchain-as-a-Service).

Bittrex Global (Link to the listing announcement)

TBA

Website

https://www.cratostoken.com

Contact

David Kang

david@cratostoken.com

+82 10 5287 6291

#Eclipton is a blockchain-powered Social Media platform that also offers a great opportunity to start and enjoy your freelancing career.

ReplyDeleteExcited, right? Want to know more about this freelancing feature of Eclipton?

Visit: https://eclipton.com/

#cryptocurrency #nft #nfts #blockoville #cryptocurrency #freelancer #freelancing

#blockchain #eclipton #blogger #blogging #socialmedia

SOLACIT Announces Its Arrival with the New DeFi Project, built up on the Solana Chain

ReplyDeleteTo know more visit: https://solacit.com/

#SOLACIT #defi #ico #bnb #bsc #nft #nfts #buynft

Great post

ReplyDeleteAxie infinity clone script

Opensea clone script

Zed run clone script

cryptopunks clone script

Decentraland clone script

ReplyDeleteNFT Marketplace Development Company

Opensea clone script

Rarible clone script

Axie infinity clone script

Zed run clone script

NFT Game Development Company

Metaverse NFT Marketplace Development Company

Token Development Company

ReplyDeleteToken Development Services

Cryptocurrency Development Services

NFT Token Development Company |

Stablecoin Development Company |

Metaverse Development Company

ReplyDeleteMetaverse NFT Marketplace Development Company

NFT Marketplace Development Company

Axie infinity clone script

Zed run clone script

Opensea clone script

Shootpad team is proud to announce their Decentralized Multichain IDO Launchpad Demo about to be released on the Cardano blockchain as the $SHOOT Token Seed Sale is still on going.

ReplyDeleteThe seed sale is an opportunity for early backers to purchase $SHOOT token at a lower price before its listing on major exchanges.

In order to participate in the Seed Sale, visit this link: https://sale.shootpad.io/

About ShootPad

Shootpad is a decentralized accelerator and incubation platform connecting early stage innovators and projects with our community of investors. SHOOTPAD view Hundreds of Cardano Native Token Seed Sale, pre-sale and ISPO powered by the utility token $SHOOT.

$SHOOT Token Seed Sale details

Seed sale allocation: 76,000,000

Seed sale price: 1 ADA = 570 $SHOOT Tokens

Minimum Buy Amount: 100 ADA

Maximum Buy Amount: 10,000 ADA

Note: Any amount below the minimum will be lost or result in not receiving the tokens.

How To Buy $SHOOT Tokens

Step 1: Purchase ADA from any cryptocurrency exchange company for example Coinbase or Binance and send them to your Cardano wallet.

Step 2: Visit the $SHOOT Token Sale Page here https://sale.shootpad.io/ and send your ADA to the provided wallet Address.

Step 3: $SHOOT tokens will be sent to the wallet address used in participating in the Seed Sale.

Social Media Handles:

Twitter: https://twitter.com/shootpad_io

Telegram Group: https://t.me/shootpad_io

Medium: https://shootpad-io.medium.com/

Instagram: https://www.instagram.com/shootpad.io/

Website: https://shootpad.io

DAO Blockchain Development Company

ReplyDeleteAxie infinity clone script

Zed run clone script

Cross Chain NFT Marketplace Development Company

NFT Marketplace Development Company

Opensea clone script

Pancakeswap clone script

Thank you for sharing this information.

ReplyDeleteBitcoin is valuable because it is used as a form of money.

I feel happy about it and I love learning more about poocoin stock.

'Wow this is the great' post about bitcoin. I love to come again . You can also check out my latest post on similar topic poocoin stock

DeleteThis is a wonderful post. I would love to come again. You can also checkout my postpoocoin stock.

ReplyDeleteThe NFT space is being disrupted by a new player making waves within the industry. EGO.com, an up-and-coming Cardano NFT marketplace, is barely a few weeks old but is already turning the heads of major retail and institutional investors for its promise to facilitate a “Digital Renaissance” in art. Analysts are closely watching the developments of this “crypto gem”.

ReplyDeleteEGO.com, a self-described decentralized creative realm for artists and collectors, has differentiated itself within the industry through its iconic name and innovative marketing strategies. The project has already established itself as a key player within the market for Cardano NFTs with a promise to facilitate “Digital Renaissance” in modern art.

Now, after taking into account feedback received from its community, it has released a sneak peak of its online platform, with a more professional and intuitive user interface designed to provide a radically better user experience.

The project has seen substantial interest from both investors and other projects within the NFT space. Although the project is barely a few weeks old, more than 25 projects have already committed to hosting their NFTs on EGO.com, while the private sale has been setting new records for retail investor participation. EGO.com is currently in the process of conducting a private sale until June 15, inviting private investors to participate by reaching out to sales@ego.com.

After having secured public sale rights on ADAX, a Cardano-based exchange, EGO.com will officially open the doors for all to participate on June 16 with an initial price set at $0.16. Early projections based on private sale data signal the high likelihood of an oversubscribed first round, in anticipation of an early post-sale ‘pop’ in token price.

Many analysts attribute the rapid pace of success to the fact that EGO.com has amassed a team of seasoned professionals with years of experience within the world of NFT, as well as within the fields of finance, marketing, and business operations. With Reuben Godfrey as CEO and his substantial expertise within NFT space, Fabien Arneodo as CSO and marketing guru, and Andrej Benc as CTO - the project’s C-class management already reflects the high level of experience EGO.com brings to the NFT space. Business operations are also supported by Patrik Lööf as Marketing Advisor, Mindaugas Stelmokas as Sales Manager, and Edward W. Mandel, so called King of NFTs in Miami, responsible for Business Development. Overall, the dedication of individual team members is clearly demonstrated by the numerous achievements we have already seen within the relatively short project timeframe.

About EGO.com

EGO.com is a fully decentralized creative realm built on the backbone of Plutus smart contracts. Led by a team of artists, art dealers, and DeFi professionals, EGO.com is harnessing the power of NFT technology to ensure that artists and collectors make the most of their digital assets. Artists can show off their prowess by minting NFTs of their artwork. Collectors can earn rewards from staking their Cardano-based NFT collections. Investors can hedge against short-term price fluctuations in style. Every step towards the ‘Digital Renaissance’ in art, EGO.com is there to provide professional, 360° degree support for all of your NFT needs.

Social Media

This is Informative Blog Content.

ReplyDeleteToken Development Company

Stablecoin Development Company

Whitepaper Writing Services

BEP20 Token Development Company

Metaverse Token Development Company

ERC20 Token Development Company

Polygon Token Development Company

NFT Token Development Company

Opensea clone script

ReplyDeletePancakeswap clone script

Binance Clone script

Metaverse Development Company

Metavere Token Development

Axie Infinity Clone Script

NFT Marketplace Clone Script

ReplyDeleteMetaverse Clone Script