Goodbye to Ripple

Additional Note: within a couple of hours of posting this article to the Reddit/Ripple forum, i was banned without warning or reason given. It's worth noting a few things:

1) over the course of the last several months, i have seen literally tens of thousands of referrals from the same subreddit to my blog - particularly my initial analysis. though i knew it might upset some people (and i swear, i take no joy in receiving angry messages), i felt an obligation to share my updated views on the forums where my previous work had gotten the most attention.

2) It has been about a week now, and despite thousands of reads (and public calls to those 'smartest people in the room' on ripple, there have been no meaningful refutations, rebuttals, or even serious questionings of the piece below. just ad hominem attacks, expressions of faith and hope that ripple will be successful (without addressing why a higher price for the XRP coin is necessary for that).

4) That Reddit banned me as they did makes it clear that the Ripple subreddit should not be relied upon as an unbiased source of information. if all they will generally allow are posts and opinions that support the bull case, then it is no different from a 'pump piece' or cheerleading section. Immediately before I was banned, my post was aggressively downvoted (which removes it from the feed for most readers). Investors and speculators alike should beware.

-----------------

Goodbye to Ripple

1) over the course of the last several months, i have seen literally tens of thousands of referrals from the same subreddit to my blog - particularly my initial analysis. though i knew it might upset some people (and i swear, i take no joy in receiving angry messages), i felt an obligation to share my updated views on the forums where my previous work had gotten the most attention.

2) It has been about a week now, and despite thousands of reads (and public calls to those 'smartest people in the room' on ripple, there have been no meaningful refutations, rebuttals, or even serious questionings of the piece below. just ad hominem attacks, expressions of faith and hope that ripple will be successful (without addressing why a higher price for the XRP coin is necessary for that).

4) That Reddit banned me as they did makes it clear that the Ripple subreddit should not be relied upon as an unbiased source of information. if all they will generally allow are posts and opinions that support the bull case, then it is no different from a 'pump piece' or cheerleading section. Immediately before I was banned, my post was aggressively downvoted (which removes it from the feed for most readers). Investors and speculators alike should beware.

-----------------

Goodbye to Ripple

Summary

- I feel the need to ‘set the record straight’ on my current Ripple views – especially as I see others use my original analysis in unsavory ‘Pump Pieces’

- I no longer think my original analysis should be used to value Ripple. With what I know now, I see my initial ‘valuation’ of ~$0.83 per coin as far too high. I now replace this with a per-coin value of ~$0.05

- What have changed are my perceptions of the possibility of Ripple being used as ‘money’, required inventory hold rates, and penetration of the market in the face of a competitive response.

------------------------------------------------------------------------------------------------------

When I was first becoming acquainted

with blockchain and altcoins I thought that Ripple was the 'right horse to bet

on'. It was exciting to me to find a new area in the (potential

investment) world where I could use the analytical tools in my kit, and bring

some clarity to the situation.

With what I knew then, I did what

was intended as a thoughtful analysis, focusing

on its potential utility for international money transfers - while holding out

hope that it might somehow carry the mantle of the 'greater crypto' world.

I realize now that I was wrong.

I had an inkling of it a few months

ago, which is why despite having mostly moved on (and largely lost interest in

ripple) I still felt obliged to share some updated thoughts on it, which it was

my hope, would point out some issues to a genuinely interested (and skeptical

reader).

But instead of people

focusing on my update and asking more questions, I find that people are still linking

to my original analysis, and even referencing it in pump-pieces that belittle

and misrepresent my work (P.S. Taking credit for a type of analysis after you

have read it from someone else makes you a plagiarist. Never mind that the particular

‘author’ I’m addressing – who has not responded to my polite request to change

his posting - still managed to wreck the material.)

So despite being

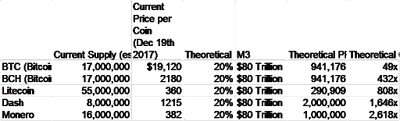

relatively bored with XRP, and having since moved on to an in-depth and exhaustive Bitcoin piece of which I'm very proud (which will soon have a

significant update, especially as it pertains to Monero) I find myself coming

back to XRP to attempt to set the record straight on where I currently stand on

it.

I currently believe that XRP

is a losing proposition for three broad reasons.

1) XRP misses the 'bigger

point' of cryptos at large

*NOTE* - this is not an issue I outlined in my earlier piece - nor is it an expressed purpose of RIpple. I mention it here because I believe there are still significant numbers of people who ascribe some value to ripple in the hopes that this may still yet 'come to pass'. I wish to disavow people of this notion. If this hurts your sensibilities, then by all means, skip to the next section.

*NOTE* - this is not an issue I outlined in my earlier piece - nor is it an expressed purpose of RIpple. I mention it here because I believe there are still significant numbers of people who ascribe some value to ripple in the hopes that this may still yet 'come to pass'. I wish to disavow people of this notion. If this hurts your sensibilities, then by all means, skip to the next section.

While it has

payment processing time benefits (for now) this comes at a significant cost. The

supply and system is ultimately in the hands of the company, who despite

their claims of libertarian principles, instead in action aspire to work with

the very banks and bankers who have facilitated the unsound money world we live

in today. As such, any

hopes for XRP to eventually be considered ‘money’ in its own right – that is,

have a value beyond functional utility – are unrealistic and out of accord with the most encompassing aspects of blockchain. (To be fair, I didn't really attribute any of RIpple's value to this in the prior analysis, but I felt it worthwhile to address here).

This then brings us to its value as a means to facilitate cross-border transactions.

This then brings us to its value as a means to facilitate cross-border transactions.

2) My ‘Functional

Utility’ analysis – and the example I originally gave is far too optimistic –

to the point at this stage of being flat out wrong.

But first – a quick

note on non-cross border transactions. Some people claimed that my original

analysis was too conservative because I only focused on cross-border

transactions. They claim that if you include intra-country transactions, the

upside is much greater.

This argument is

without merit.

The reason

cross-border transactions have been targeted by Ripple (and why I exclusively

focused on them in my analysis) is because they,

not intra-country transfers, are the ones that operate within a

currently massively over-complicated, overpriced system. It is for this reason

that Ripple ever has had a chance of

establishing a foothold on an economic basis through technological disruption.

--------------

--------------

The first correction

I make here related to my estimation of what % of all the ‘float’ traders would

need to hold in order to accommodate all the transactions. I had originally

estimated 35%. But I now see that as far too high.

Most B2B

international transactions do not need instant transfer or confirmation. 6, 12

or even 24 hour confirmations for most businesses would be most of what’s required

– so long as the costs came down as well. As such, most transactions could be

done in batches, and therefore netted

– meaning that on average, far less Ripple would need to be held to effect the transactions:

only that which is necessary to accommodate the amounts that exceed the ‘nettings’.

As such, I would reduce my 35% by 2/3 to ~12%. This of course brings my

valuation down by 2/3… but there’s more.

The second

correction I make here related to Adoption rates. I alluded in my Update to the

fact that I thought Adoption rates were the big risks – but again, this hasn’t

gotten the attention – so I focus on that here.

The main

competitor to Ripple in foreign interbank transfers is the SWIFT organization

and system. (In hindsight, I should have spent far more time on the competitive

response than I did in the original report). Not only is SWIFT the incumbent for

a notoriously reluctant-to-change customer base, but they are launching their ‘response’

to the business-threat of Ripple (and crypto in general) with their ‘GPI’.

Their GPI claims

to lower fees and transaction times, while increasing transparency. I don’t

know much more about it than that. But frankly, I don’t think I need to know more about it, and here’s why: it’s probably

enough.

Even if GPI falls

short of Ripple in technology, speed, etc… it’s still a far easier choice for a bank to stay

with SWIFT and give them time/space to upgrade their systems… so long as they

are getting a discount to historical rates.

Can SWIFT build a

system that can come close to Ripple? That’s an excellent question – so let’s

think about it.

Ripple is

open-source. This means that much if not all of the code is freely-available.

What’s to stop SWIFT from cherry-picking the bits they like, and launching

their own ‘version’ to effect similar outcomes? All this while giving their

clients the peace-of-mind that the fallback old system still works in case of

emergency.

Well, one thing

to stop SWIFT from successfully launching a good competing product (that is just enough to keep their clients from

switching) is money. How much money are they willing to spend on it?

Well, considering

that if they did nothing, their

entire business is at risk, it seems like it should be a high priority. Do you

think they could re-create a Ripple competitive system (leveraging the open-source

nature of the tech) in 1-2 years if they spent $50 million? How about $1

billion?

Considering that even a $1 billion

investment could potentially protect for them what is a multi-billion annual

profit engine, the economic motivation to try is a no-brainer (and the funding

probably already available).

I do not see any

reason to believe that Ripple has significantly accelerated its very early

success in getting banks to use their system. If anything, there are many

reasons to believe that their penetration prospects are far worse than even a

few months ago – particularly as bigger banks develop their own systems (surely

JP Morgan can do the same thing with ETH), and smaller banks sit-on-their-hands

waiting to see where the technology goes before they stick their necks out. As

such, the notion of Ripple getting 30% of the global market in 3 years should

in my view be replaced with the prospect of a 5% market share.

So my ‘present value’ per coin number of $0.83 should first

be divided by 3 (as per my comment above) and then again divided by 6 - making it worth today ~$0.05: or more than 75%

lower than current price.

Alternatively,

you might be saying to yourself... what is SWIFT simply bought Ripple? This way they could get all their technology in one

fell swoop! Well, that’s all well and good, but the cost of doing so at current prices would be many billions

of dollars paid to the Ripple consortium. Why do that, when you can just

re-create your own system for much less? If the price of XRP crashes

significantly, then maybe it would be

worthwhile for SWIFT to buy Ripple – but of course that would be at drastically

lower prices.

To Ripple

supporters, I would just like to say, none of this is personal – and hey, maybe

I’m flat out wrong about my current perspective. Time will tell, and as always I welcome constructive feedback. If presented with new information, I will of course reassess. But especially

as I saw people using my earlier work (which is no longer representative of how

I feel) in ‘pump’ pieces, I felt the obligation to set the record straight now.

Izzy

P.S. made it this far? thanks for reading! Why not go just a little further and check out my postscript to this article? There's a good example in there which I came up that has some numbers which i think adds some real value to understanding. Cheers

Here's a step by step guide to setting up a wallet and buying Ripple: https://buyingripple.com/

ReplyDeleteVery interesting points. I always disliked Ripple and learning about the Swift GPI just now is just icing on the cake.

ReplyDeletelol. hahaha. you made me laugh so hard :D Swift GPI is 6 years away from being tested. enjoy waiting if you cant even wait for ripple to get implemented :D

ReplyDeleteThe Ripple network & Ripple XRP coin are two completely different things from each other.

ReplyDeleteI'm no't sure if this comes into the equation. I came across it researching Hyperledger. And reading your article I thought of it. Thought I would share.

ReplyDeletehttps://ripplefox.com/

Quite funny reading this now when price just surged to 0.80 :)

ReplyDeletehaha yes, it hit $.89, whoops!

ReplyDeletehaha yes, it hit $.89, whoops!

ReplyDeleteGoodbye to Ripple, Hello Monero. Hosting provider with over one million users worldwide would like to announce a new chapter:

ReplyDeleteWe have opened CoinImp, a Monero JavaScript web miner with the lowest fees on the market - 0.02 XMR! Your users will mine Monero (XMR) in their browser for you while they search, play or even stream a video. They will pay you with their CPU power, as simple as that. You can also try our easily configurable local miner. Register and start mining, no more steps! Site at https://www.coinimp.com

Great read! Follow daily Ripple, Bitcoin, Monero and other cryptocurrency trends and news

ReplyDeleteIt seems to me that banks don't hold the keys to the car anymore and won't be able to dictate to businesses that they have to wait any amount of time for value to transfer. If a company out there is offering instant deposits, streamed directly to your wallet, particularly in regards to digital media, the banks won't have a leg to stand on.

ReplyDeleteThis second post seems more emotional than the first one. It seems a little less analytical to me. Banks live in a sheltered world protected by regulations designed to protect consumers. They're about to witness something aimed directly at the weakness created by their control, and that is speed, transparency, and reliability.

For more detailed information check:

ReplyDeleteripple mining

ReplyDeleteYou probably saw how Bitcoin increased over 900% over the course of last year.

It was wild but not totally unprecedented if you’d been watching cryptocurrency over the last several years.

And here’s the crazy thing:

There are many other coins that still have tons of room to grow.

You may have heard of Ethereum, Litecoin, Ripple, and others but there are more coins and many more opportunities -

Follow the link below to get the full story.

https://cryptocrusher.net?46df4gsd4f

Ripple

ReplyDeleteThanks for your information visit us at.Ripple

ReplyDeletesucks to get banned.

ReplyDeleteRipple, also know as XRP, you can store securely in some popular XRP wallets. Here at cryptocall support you can buy Ripple, you can also take Ripple Support Phone Number, dial Ripple customer Phone number and get full support, Ripple Phone number +1-833-313-7111. If you face any problem in buying ripple contact at Ripple issues support Number they will guide you.

ReplyDeleteNow that you know how to keep your XRP safe with the help of the out Expert who always ready for your help. Ripple issues support Number |Exchange Ripple|Ripple Exchange | Ripple exchange customer support number.

Visit: https://cryptocallsupport.com/ripple-customer-support-number/

Are you having trouble in login to the Blockchain account? Are you looking for remedies and solutions to deal with this error? You need to ensure that you have entered the right email ID and password and also, someone else has no access to your account. If still you have no answers related to queries, you can always take help from the team who is there to guide you. You need to make a call on Blockchain support number which is functional all the time. You can connect with the team and avail solution from the professionals who’re there to help you. You can call them and get verified solutions from the skilled professionals in no time. Blockchain Support Number

ReplyDeleteThese days improper functionality of Google authentication in Ripple is being found in a broad way. This directly affects the security of the user’s fund and hence need to be resolved as soon as possible. Therefore users should instantly call our Ripple support number without any delay. Issues of such kind may instantly be resolved if users are cautious to get in contact with concerned professionals. You will be directed to the experts who will provide the inventive solutions and remedies so that you get out of the error in the best possible way. <a href="http://www.cryptowalletsupport.com/ripple-support-number/>Gemini Support Number</a>

ReplyDeleteThese days improper functionality of Google authentication in Ripple is being found in a broad way. This directly affects the security of the user’s fund and hence need to be resolved as soon as possible. Therefore users should instantly call our Ripple support number without any delay. Issues of such kind may instantly be resolved if users are cautious to get in contact with concerned professionals. You will be directed to the experts who will provide the inventive solutions and remedies so that you get out of the error in the best possible way. <a href="http://www.cryptowalletsupport.com/ripple-support-number/>Ripple Support Number</a>

ReplyDeleteThese days improper functionality of Google authentication in Ripple is being found in a broad way. This directly affects the security of the user’s fund and hence need to be resolved as soon as possible. Therefore users should instantly call our Ripple support number without any delay. Issues of such kind may instantly be resolved if users are cautious to get in contact with concerned professionals. You will be directed to the experts who will provide the inventive solutions and remedies so that you get out of the error in the best possible way. <a href="http://www.cryptowalletsupport.com/ripple-support-number/”>Ripple Support Number</a>

ReplyDeleteAre you having trouble in selling and buying bitcoin in Binance account? The process of trading on the exchange is quite normal but sometimes due to few errors, users get into trouble. If you want to eliminate this issue and need solution to fix them as soon as possible, you can always take support from the team who is there to support you. You have to call on Binance Support Number which is functional and users can talk to the team regarding the trouble and avail fruitful solution in no time. Binance Support Number

ReplyDeleteBinance support phone number to all the users for help. Just call the number and get the required help. The expert team will assist you step-by-step throughout your problem.

ReplyDeleteIf you are facing any issues as per the above points you are free to call anytime to our Binance customer service phone number that is working 24×7.Binance Support Number | Binance customer support number | Binance customer service phone number.

Visit : https://cryptocallsupport.com/binance-support-number/

Are you facing error while sending digital currency to another wallet in the Binance account? Being surrounded by errors while trading on the exchange is quite common but the problem arises when users are unable to deal with errors. If you don’t know how to resolve this error, you can call on Binance support number which is functional all the time for assistance. You can contact the team anytime for availing solutions that are easy to execute. Binance Support Number

ReplyDeleteBlockchain exchange is the leading exchange across the world and known for its features. Login process of Blockchain account is quite easy but a few users due to less technical knowledge are unable to continue the process. If you don’t know how to deal with such errors and need assistance, you can always call on Blockchain phone number which is always functional and users can talk to the team anytime for availing fruitful solutions. You can reach to the doors of the team anytime for attaining solutionsBlockchain Support Number

ReplyDeleteAre you unable to receive bitcoin from other wallets in Blockchain account? Bitcoin is the popular coin and used by traders for the purpose of trading. If you are looking for solution to deal with such issues, you can always take help from the team of skilled professionals who are there to assist you. You need to call on Blockchain support phone number which is all the time active and users can have conversation with the team anytime for availing quality solutions. The team is always there to deal with your troubles and issues in no time. Blockchain Support Number

ReplyDeleteBinance is the popular exchange that provides the platform for trading. If you don’t know how to get verified your account and you’re looking for solution, you can always take help from the team of elite professionals who are there to assist you. You can call on Binance support number which is functional all the time for assistance. You can have conversation with the team anytime for quality results. Whenever you’re in doubt, you can always ask for help from the team of skilled professionals who are there for assistance. Binance Support Number

ReplyDelete

ReplyDeleteآهنگ های محسن چاوشی

آهنگ های آرون افشار

دانلود آهنگ انگیزشی

آهنگ های پرطرفدار جدید

آهنگ تولد ترکی

ریمیکس شاد ترکیه ای رادیو جوان

دانلود آهنگ سالگرد ازدواج

دانلود آهنگ های شاد تالار عروسی

off white hoodie outlet

ReplyDeletebapesta shoes

curry 9

kyrie 7 shoes

yeezy

bape outlet

curry 6

golden goose

yeezy boost 350 v2

kyrie shoes