Monero Valuation Musings

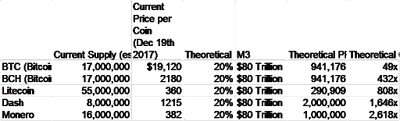

EDIT: I neglected a critical aspect of this analysis by not paying proper attention to the concept of stock-vs-flow. I am especially grateful to the r/monero subscriber who very kindly and extremely quickly corrected me on these points. The net result, as it turns out, is still not too dissimilar from the results below... especially when variability of assumptions is high. I recommend you check out his response on the sub. I'll try leaving this article here (as a monument/remind to me of my error) but wrap it with the conclusion of, as he put it- 'broad acceptance in the global black market = moon for monero/privacy coins no matter how calculated.' note to self: entitling something 'musings' doesn't mean you can't scrub it better than you did here. ------------------------------------ ------------------------------------- ------------------------------------- - In the course of responding to a comment posted on my blog yesterday (response in t...