ICO Analysis: TenX/PAY

TenX/PAY: Upcoming

Coin Auction Analysis

Numbers Above Aside... there could be even bigger inherent problems in the strategy

Example:

Although I had intended to dive right into preparing my next

coin valuation report (which is NOT about TenX or PAY), I find myself taking a

slight detour here.

A couple of days ago I received an email from a reader who

asked that I take a look at the TenX coin and its upcoming ICO (initial coin

offering). After skimming the white-paper I was intrigued and spent some time

thinking about it - which leads me to this report. Considering the fact that

the coin auction is so near (and that I have reached some tentative

conclusions) I figured I would bump TenX to the front of my queue and share my

analysis now.

DISCLAIMER: The

following is my personal take on TenX and the PAY coin which they will be

offering in a few weeks. I hope you find it interesting and/or useful. If I get

anything materially wrong, I trust that people will let me know to correct me (and

which I’d be happy to acknowledge). As it stands, these are just my views and

thought processes. All the info I used in this report is accessible either via

the TenX website or through the references in my footnotes. You should always do your own work and

reach your own conclusions.

TenX:What is it?

TenX is a technology (and business) that seeks to enable

users to spend their cryptocurrencies at POS (point-of-sale) locations that

accept credit & debit cards (i.e., MasterCard, Visa and others).

The use case is basically as follows:

(note that I’m probably off with regard to precise details, but the gist of

it ought to be ok for our purposes):

Bob has 1 ETH currently worth $350 in his TenX ETH wallet

(which he can access on his phone) and has a physical TenX card that looks exactly

like a credit/debit card. It’s linked to his TenX account.

Bob goes shopping for some new shoes at Harry’s Shoe Store and

finds a pair he likes that cost $175. As payment for the shoes, Harry accepts

several forms of payment: cash, Visa/MasterCard credit cards, or Visa/MasterCard

debit cards. But Bob wants to pay for the shoes using the ETH in his wallet.

So Bob whips out his TenX card and swipes it through Harry’s

credit card reader. Even though it’s not a standard Visa or MasterCard card, it’s compatible with the reader. The

transaction goes through, he gets a printed receipt saying he paid $175 from Harry

and he’s done. He looks at the TenX ETH wallet on his phone and sees that the

balance is now 0.50 ETH.

So what exactly just happened?

When Bob swiped his TenX card, it transmitted his account

number through the Visa/MasterCard system and synched up with TenX’s network.

The TenX network then looked at where ETH was trading relative to US$ (via its

own trading platform) and figured out that to pay $175, he would need to spend

0.5 ETH – so it deducted 0.5 ETH from Bob’s ETH wallet. This is why he had only

0.5 ETH left when he checked after the transaction.

But Harry needs to be paid – so TenX takes that 0.5 ETH, and

trades it for $175 – the purchase price of the shoes. It then transfers that $175

into Harry’s Visa/MasterCard accounts… less the usual credit card surcharges

(predominantly what are called interchange fees). In case you didn’t know, when

you buy something from a store on a credit card or debit (in the U.S.), the merchant

actually doesn’t get the full purchase price you pay. He might get only 98% of

the purchase price, with the rest going to pay the companies involved in the

card network (Visa, MasterCard, banks, etc.). For the purposes of this paper, let’s

assume that all card processing charges are 2% of the transaction price (and

the merchant foots that bill by receiving less in terms of revenues).

Seems like a neat transaction, right? Bob was able to quickly

and simply use his ETH to buy

something in a shop, and the process was just like swiping a credit/debit card.

The promise of TenX is that it may enable users to spend

their Cryptocoins (not just ETH, but presumably dozens if not hundreds of other

coins) just this easily at any of the bazillion shops in the world that accept

Visa/MC/etc. If Bob didn’t want an actual physical

TenX card, then no problem – they have a solution to do the whole thing just by

holding up his phone and swapping some scans.[1]

How does TenX make

money?

Remember that 2% surcharge that goes to the card processing

companies (Visa/MC/Banks)? Well, TenX has negotiated a deal with those

companies to let TenX keep part of that, or 0.5% of the total transaction

value.

In Bob’s case, that would be 0.5% of $175, or $0.875 that

goes to TenX.[2]

So how does a COIN

and an Initial Coin Offering come into this?

TenX is looking to raise money to build out their

systems/network/business. That’s what the auction is about - they sell coins

(which they call PAY coins) in exchange for investors to give them ETH. They

will then use the ETH to fund their business plan.

What’s PAY? A Cryptocoin

like BitCoin or ETH?

As I understand it, not really. While in some ways it may

technically be called a cryptocoin (depending on your definition), it’s not

really a blockchain asset. It’s basically just

a share of stock in the Company (with no voting rights). The main

difference (legal and regulatory issues aside) between the PAY token and a

share of stock lies in how its economic value is defined.

Remember when I said that 0.5% (or 87.5 cents) of Bob’s

transactions goes to TenX? Well, that wasn’t entirely accurate. It’s actually

designed to be evenly distributed amongst all the holders of the PAY tokens.

TenX management and pre-ICO investors currently own 100% of

all PAY tokens, so if Bob did that transaction right now, they would get all of

that 87.5 cents. But if YOU own half of all the PAY tokens, then you get half

of that - $0.4375 which will be distributed to you in the form ETH (at $350

per ETH, that means you would receive a distribution of .00125 ETH).

To raise funds, TenX is offering (up

to) 51% of all PAY tokens that will ever exist to the participants in the

upcoming auction. The price they’re asking is 1/350th of an ETH for each PAY token,

which assuming they sell hit their ‘sell cap’ of 200,000 ETH (and you assume 1

ETH = $350) means they’re selling a maximum of 70 million tokens for $1

each. That 70 million represents 51% means the grand total of all PAY tokens

outstanding is just short of 140 million.

Therefore, at $1 a token, the implied value (at this ‘round’ of

financing) of ALL the PAY tokens is roughly $140 million. Remember that number – we’ll be coming back to

it.

So What might PAY tokens be worth?

Here’s where we come to the heart of the valuation part.

We’re going to view it from the perspective of how much a PAY token would be

worth, relative to what you paid for it at the ICO ($1). We can do this by

estimating a valuation for ALL of the PAY tokens at some future point, and

divide that by 140 million. This will

give us the value per token. If for instance the future value is $1.4 billion for

all the tokens, then each token you bought at the ICO for $1 would be worth $10.

Forecast/Valuation Walkthrough

When I first looked at this, I thought the right approach

was to see how big the credit/debit card transaction processing market is and

might be. With a little digging[3]

I discovered that U.S. debit purchase volumes in 2016 were about $2.5 trillion. If you include credit cards,

that number goes to nearly $6 trillion.

Let's use really rough numbers (and I could be off by factors, but for

this exercise it’s ok) and say global volumes are 3x the U.S. volume – so

$18 trillion. But this was in 2016 – let’s think about 2020. That $18 trillion

could grow at a CAGR of 5% to $21 trillion! Wow!

If TenX garners 0.1% of that volume (just one in 1000

‘swipes’), that would be $21 billion in annual TenX transactions. At 0.5% in

fees, that would be annual earnings of $105 million. Since this is annual

‘earnings’, let’s use a stock-market type multiple (considering the presumed

growth) of a modest 15x. That means all 100% of the PAY coins would be worth 15x $105 million = $1.575 billion. Versus the initial valuation of $140 million,

that’s over 11x higher! And what it they get 1% of all transactions??!? Then it

would be 10x that or a total return of 110x!! If we also use a higher multiple than

15 then the number goes up further.

But not so fast.

Let’s think about this again, but a little differently.

Does it really make sense to approach this from the

perspective of all current credit/debit transactions? When dealing with numbers

this big, it’s tempting to do so then assume what seem like ‘easy’ target

penetration levels (what’s 0.1% after all between friends?). But this can be as

misleading as it is enticing.

The question to ask is: who are the people that will actually

be performing these TenX transactions? Answer: people who own Cryptocoins – no one else.

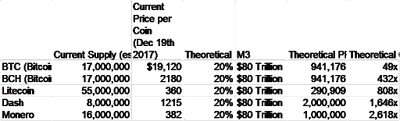

As of right now, let’s assume that the total value of all

Cryptos is $100 billion – that’s BTC, ETH, XRP, and everything else (even the

ones of which I am ‘not a fan’).[4]

Let’s also take another step back and think about valuing PAY tokens relative to just investing in, say, ETH

or XRP.

Now we can run some better numbers.

Let’s assume that the value of all Cryptos goes up 10x in

the next 3 years. Whether you think that’s high or low, stay with me. It

actually doesn’t matter as we are looking at our PAY valuation relative to Cryptos

in general. Doing this though, we now have a base 10x return level to which we

can compare PAY token projected returns. Said another way, in a future where

all other Cryptos have gone up 10x, then if our estimate for PAY tokens isn’t

at least $10 (or 10x the ICO valuation) you’d be better off just buying other

coins.

So in our example, all Cryptos are worth 10 x $100 billion

or $1 trillion.

Now: of that $1 trillion – how much will be earmarked as

‘investment funds’ versus funds that people will want to spend ‘buying stuff’?

If you’ve got $100,000 in XRP, and 3 years from now it’s

worth $1,000,000, are you really going to spend it all on purchases then? After

all, it may keep going up. You don’t want to be like the guy who paid 10,000

bitcoins for a pizza several years ago (making it I think the most expensive

pizza in human history). So you will likely have at least some reluctance to totally cash out. Let’s say that on average, 35%

of the total gets spent, with an annual velocity of spend of 1x/year. I think

that’s being generous.

But how much of those purchases (in terms of aggregate

dollar value) are going to be spent via Visa/MC payment systems?

Most of that 35% (or $350 billion) of purchases will be on

big-ticket items – cars, houses, etc. Things you don’t pay for on a credit

card. That’s just the way the math works – large numbers skew the average

higher. You could of course pay for a

house with a credit card in theory, but no seller of a house wants to give a 2%

fee to VisaMC when you can just wire the money directly. So let’s say that 80%

of all purchases will not be Visa/MC type purchases (meaning 20% may be).

Now our annual TenX volumes are 20% x $350 billion = $70

billion, or 7% of our

theoretical forecast total crypto valuations.

But there’s more.

Think about how concentrated most of the crypto wealth at

that stage will be. That $70 billion of possible credit/card purchases is not

evenly distributed as $10 worth of Cryptos to each person on the planet. It’s

instead going to be far more skewed.

Most Visa/MC type purchases are of a relatively low $ amount

(think buying groceries versus buying a house). But if you happen to be a

crypto ‘whale’ and have $10 million worth of ETH, are you really going to spend

7% or $700,000 a year on groceries and other things that you’d run through the Visa/MC network? Highly unlikely.

I think a very reasonable factor to reduce that $70 billion

by is 5, so 70 / 5 = $14 billion – or a far more meager 1.4% of the total

global crypto value.

SO – now we have a new estimate for total annual

transactions run through the TenX network in 3 years’ time (where Cryptos in

general have gone up ten-fold, and assuming TenX gets 100% of this

business): $14 billion. Annual transaction fees of 0.5% on that amount come to $70

million. If we apply our same 15x multiple, then all the PAY coins would be

worth $1.05 billion[5] - or 7.5x our initial valuation of $140

million.

But remember, we would have earned 10x just by being invested in the average cryptocoin – so

the PAY token in our example underperforms the growth in Cryptos in general by

25%. If our investment in a particular cryptocoin did ‘better than average’ for

the asset class as a whole, then the PAY token valuation underperforms by even

more.

But wait – there’s more that needs to be considered.

I think it's likely that if you are a registered

PAY token holder, each of those distributions they send you will be reportable at

the very least as personal taxable income. Now this isn’t a problem with regard

to valuing all the coins with stock-market-type multiples (as stock

distributions and share sales are taxable), but you need to consider how this

might compare to your tax burden of just investing in Cryptos (earnings, versus

capital gains, versus other considerations[6]).

You might be saying ‘Hey Izzy,

but a 15x multiple is too low! This thing could grow be seen to have enormous

growth potential. It should be a 30x multiple!” Well, yes, in that case your

return versus Cryptos in general would be (before tax consideration) about 1.5

times. But remember – this assumes that TenX gets 100% of all these purchase

transactions, and I don’t think that is likely for reasons I’ll explain in a

moment.

Numbers Above Aside... there could be even bigger inherent problems in the strategy

But more so, from a practical perspective: I

see competitive adoption issues of the TenX platform that I don’t think will resolve

easily (if at all). After all, if Cryptos do

go up in value significantly, won’t even merchants

want to be increasingly paid in the coins themselves (rather than having it

converted to fiat currency)? Wouldn’t the merchants want to not pay the 2% fees to the credit card

companies and banks if they could just accept the coins directly? And won’t

there be more and more technologies enabling merchants to do just that? 'First mover advantage' only holds if the second, third and fourth movers don't offer a service that's better and cheaper with little in the way of switching costs.

I'm sure there will be dozens of smarter, cooler and less expensive ways to process POS cryptocoin transactions away from TenX.

Here’s just one scenario I can imagine - picture this: a POS payment system sponsored by Crypto-exchanges (who could be the perfect foil to the whole TenX enterprise). Crypto-exchanges could invest in the technology for a ‘coin payment reader’ that links back to their exchange. Let’s call the Crypto-Exchange company sponsor we use in the example 'Crypto-Ex'.

Here’s just one scenario I can imagine - picture this: a POS payment system sponsored by Crypto-exchanges (who could be the perfect foil to the whole TenX enterprise). Crypto-exchanges could invest in the technology for a ‘coin payment reader’ that links back to their exchange. Let’s call the Crypto-Exchange company sponsor we use in the example 'Crypto-Ex'.

Example:

Bob goes into Harry’s Shoe

Store. Bob wants to pay for the $175 shoes with ETH, so he holds up his phone

to the ‘coin payment reader’ (CPR) at the register. The CPR flashes a QR code that

tells Bob’s phone that the store is requesting 0.5 ETH. It comes up with 0.5

ETH as the right number because it is linked back to Crypto-Ex where the

current exchange rate is $350/ETH.

Bob then looks back at his phone

and taps ‘accept’ to allow the transfer to take place. He then holds his phone

BACK up to the CPR, displaying a QR code which the CPR reads and uses to

effectively transfer 0.5 ETH from Bob’s wallet to Crypto-Ex. At Crypto-Ex,

their systems trade the 0.5 ETH for $175, and take out a 0.25% transaction fee,

crediting Harry’s Shoe Store’s account with the proceeds of $174.5625 (as

opposed to the $171.50 that a 2% TenX transaction would charge).

That's it. The transaction is done without touching a credit card network and paying their fees.

In short: the actual payment processing that TenX does is (relatively speaking) easy to duplicate on another platform. It (basically) just seems to entail being connected to both the merchant and a trading exchange for conversions. If we still lived in a world where the extant credit/debit-card processing network was the only way to do this, then TenX would make sense. But given the fact that a) even a modest development team could come up with a competing technology that does the same thing outside of their network, and critically, b) they could offer their services for a fraction of the TenX cost to the merchant (who is the one who ultimately decides what payment systems to use) - the sustainability of the TenX business model seems to me rather dubious. They might have some early wins vis-a-vis adoption (ie, when competitors haven't yet launched), but once people get a smell for the money, competing technologies will make the extant credit-card network for these types of payments irrelevant.

The Auction

Needless to say, I don’t think I

will personally be participating in the auction. To those who are supporters of

TenX and don’t appreciate my analysis, all I can tell you is that it’s not

personal - I’m just one guy sharing his opinion when asked. I’m open to other

viewpoints and ideas, so feel free to share. Plus, recognize that people are being invited to invest real money (potentially a lot of it) and so those without an agenda should be open to an honest discussion of perceived risks and opportunities.

Additional Notes

Unlike other coins that I’ve

written about (well, one in particular) I see nothing fishy or ‘scammy’ about

TenX. On the contrary – they seem to be extremely well organized and appear to

have made solid progress on their road-map. That being said, I wanted to mention

one more thing that struck me about the whitepaper which in my opinion might be unfairly communicating more credibility than is warranted.

They mention they are backed by some big and well respected

names - like Vitalik Buterin and

Fenbushi Capital. Please realize that while this might be amazing, it might

also be a non-issue. I’d personally be surprised if Vitalik (and other big

names in the crypto world) aren’t approached on a regular basis by start-ups

and business ventures that are seeking to let them use his name/face in their

marketing materials as an ‘advisor’ to their venture. In exchange for this

‘investment’ of his (i.e., allowing them to use his name, or maybe having a

conference call or two) they might grant a substantial stake in the company

itself. It could very well be the crypto-version of buying a paid endorsement.

From the crypto-celebrity’s perspective, it’s a no-brainer – so long as the

venture seems reasonable and legitimate. In exchange for a modest ‘appearance’,

he gets a stake in a business model. To the business owners offering him the

stake, they probably view it as a quasi-endorsement (or what they hope will be

perceived as an endorsement) which is worth the cost.

Finally, if you appreciated this

article, feel free to send

an email, a ‘follow’ on Twitter, or a share on Facebook.

Best Regards,

Izzy

Izzy

[1] The

‘cardless’ feature might work a little differently. I didn’t dig into the

mechanics of it as it’s not necessary for this analysis. As I said, the gist

of my description ought to suffice.

[2] There’s

also a feature where users of TenX will receive 0.1% of their transaction

amounts in the form of PAY tokens as a ‘reward’. I don’t focus on this here as

I don’t believe it’s material to the overall analysis.

[3] I

got my numbers from the free issue of the ‘NIlson Report’ dated May 2017.

[4] I

used coinmarketcap.com as a reference. $100 billion might actually be a little

low, but not enormously, and round numbers are easier to work with.

[5] I

recognize I’m ignoring money earned ‘along the way’ of growth. Especially

considering some of the next points, I don’t think it matters all that much.

[6]

I’m NOT a tax expert. Do your own homework. I’m just flagging it as being potentially

different from generic crypto-investing.

[7]

Some would use harsher words than constraints.

Comments

Post a Comment