Monero Valuation Musings

EDIT: I neglected a critical aspect of this analysis by not paying proper attention to the concept of stock-vs-flow. I am especially grateful to the r/monero subscriber who very kindly and extremely quickly corrected me on these points.

The net result, as it turns out, is still not too dissimilar from the results below... especially when variability of assumptions is high. I recommend you check out his response on the sub.

I'll try leaving this article here (as a monument/remind to me of my error) but wrap it with the conclusion of, as he put it- 'broad acceptance in the global black market = moon for monero/privacy coins no matter how calculated.'

note to self: entitling something 'musings' doesn't mean you can't scrub it better than you did here.

---------------------------------------------------------------------------------------------------------------

In the course of responding to a comment posted on my blog yesterday (response in the comments section to ‘Sport Coach’, on this article) I dug up some interesting information around the size of black-market economies - which got me to thinking about the prospects for privacy coins more broadly and the numbers associated with them.

The net result, as it turns out, is still not too dissimilar from the results below... especially when variability of assumptions is high. I recommend you check out his response on the sub.

I'll try leaving this article here (as a monument/remind to me of my error) but wrap it with the conclusion of, as he put it- 'broad acceptance in the global black market = moon for monero/privacy coins no matter how calculated.'

note to self: entitling something 'musings' doesn't mean you can't scrub it better than you did here.

---------------------------------------------------------------------------------------------------------------

In the course of responding to a comment posted on my blog yesterday (response in the comments section to ‘Sport Coach’, on this article) I dug up some interesting information around the size of black-market economies - which got me to thinking about the prospects for privacy coins more broadly and the numbers associated with them.

In crypto-land broadly, there is currently a huge amount of

uncertainty as to which coins will be the ‘winners’ – that is, which will have enduring

and significant presence. The action today

is Bitcoin versus Bitcoin Cash and Bitcoin Gold... with no small amount of suspected

price manipulation all around I might add.

In any case, while I remain optimistic that the broader

public will eventually come around to Monero (appreciating it for its moneyness

characteristics) I recognize that there are many who feel it will always be a ‘dark

coin’ – catering to the black-market, whether than be un-official,

non-reporting, or otherwise illegal aspects of economies.

I won’t even bother here with trying to untangle the morass

that equates behavior outside the purview of government with things that are ‘bad’

(though I will give the link to this strip which I think is terrific).

However, even if we go down the path of assuming that Monero does have future only as a ‘dark coin’, the

metrics are quite interesting.

While measures of black-market activity are notoriously

unreliable, it is generally accepted that most developed countries have a

black-market economy each year ranging in size from 15-30% of GDP. For less

developed countries, the estimates go up from there. Given this, if we ascribe

a flat 15% of global GDP to ‘black market’ activities, we are probably being

conservative. Let’s do it anyway, and further extrapolate that 15% of GDP

activity is supported by an equivalent supporting money supply contribution –

so 15% of global M3 is held/used in ‘the black market’

Now, let’s make a few further assumptions and see where it

leads:

In the next 5 years,

80% of global money will be digital.

This isn’t hard to accept for most people. If it were up to

some people who want to ‘ban cash’, the number would be 100% and time horizon

would be a lot sooner. Nevertheless, let’s stick with these numbers as hopefully

accepted as reasonable.

In this time

period, the percentage of all human economic activity considered ‘illicit’ will

not dip lower than globally 15% of all transactions.

Considering that regulation and control seems to be

increasing at a rapid clip, making more and more otherwise innocuous activities

illegal (unless proper permitting, taxes, reporting, etc. are achieved) – this

is probably also reasonable if not a bit conservative.

Global M3 stays

constant at about $80 trillion equivalent.

We could argue it should be either higher or lower, but let’s

assume it stays flat for simplicity. It shouldn’t materially change our

calculus.

The best privacy

coin will garner no less than 50% of the relevant digital market.

Admittedly, this is a bit of a loaded statement. How we you

define ‘best’ is critical. Let’s for now assume it’s a generally favourable combination

of ubiquity and true fungibility/anonymity.

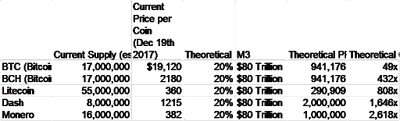

Given these assumptions now, let’s do some math:

$80 trillion global M3

X

80% Digital money

X

15% ‘black market’

X

50% penetration of leading privacy coin

= $4.8 Trillion.

If we assume for the sake of argument that this ‘best

privacy coin’ is Monero, then we may arrive at a per-coin value of $240,000 –

or roughly 600x the current price. Not a bad return I think, particularly as it

is arguably lower risk than many other coins with a ‘grand vision’… this

analysis is not dependent on jockeying for best position with government

acceptance, smart-contract supremacy, or some other functional utility which

may be either deprecated or usurped. It is instead dependent upon a facet of

human society remaining present which has done so for thousands of years – an unofficial,

‘black market’ economy.

If the broader public does ‘catch on’ to the inherent

weaknesses of other coins lacking privacy/fungibility, then the returns could

of course be more favorable – but in terms of sleeping at night, I’d venture to

say that it’s generally a safe bet to assume that there will always be demand

for ‘black market’ items. As such, even looking at Monero from the (in my mind

unlikely) prospect of never growing past a libertarian V-for-Vendetta oasis, it

presents quite an interesting value proposition.

Perhaps I’m seeing Monero through rose-colored glasses - that’s

certainly a possibility. If I am, I humbly ask the reader to share any

critique/criticism - but as far as ‘big picture, back of the envelope’ analyses

go, I don’t think this one is bad.

Finally, just one more note on investment analyses and simplicity.

Back ‘in the day’ when I was first professional tasked with developing

traditional investment theses, I thought that a ‘good’ analysis would have at

least 10 pages of historical and projected financials – not to mention all

manner of detail and usually full financial statement model flowthrough. I was

a bit taken aback when a very successful professional investor friend shared

one of his models. It was in excel,

but fit on one page. One page. And guess what – that particular thesis/trade?

Worked out like a charm.

Don’t confuse length of analysis with quality. Some of the

most useless investment reports I’ve ever had distributed to me (and which I’m

sure no one ever really read) were

also the longest and seemingly most ‘professional’

reports. Again, in ‘the old days’, there

was a wall-street maxim that if you couldn’t fit your investment thesis on the

one-page space that the old Bloomberg terminal provided as an

email/distribution mechanism, you were widely considered to be 'doing it wrong'.

Cheers,

Izzy

Yodse ecosystem overview

ReplyDeleteYodse's main purposes

The platform yodse aims to become the largest Internet ecosystem for the most convenient, rapid and profitable interaction of enterprises in the field of production of industrial product groups in the markets of Russia, CIS, South-East Asia, and later in Europe and the United States. This global, decentralized and transparent B2B / B2C trading platform has all the advantages of blockchain technology and thus provides manufacturers with the most convenient communication with their wholesalers and retail buyers. The scale, high-tech products and convenient user-friendly tools within the ecosystem will allow small and medium-sized businesses to achieve better results and gain practical benefit.

Challenges that yodse ecosystem solves

Yodse project is aimed at solving a number of problems related to direct, convenient, rapid and profitable "manufacturer-consumer" interaction. The transparent ecosystem yodse focuses on the protection consumers from losses, connected with the lack of guarantees from manufacturers and abundance of poor-quality goods. By establishing communication mechanisms, buyers will be provided with technical support, and manufacturers will receive quality feedback. The platform will reduce the delivery time and enable consumers to purchase goods without intermediaries. Excessive costs of manufacturers for outdated marketing technologies and high fees of goods placement on existing e-commerce platforms will become history. The YODSE system offers its users low fees and creates conditions for easy access of small businesses to e-commerce and international markets.

Advantages of using ecosystem (platform) yodse for manufacturers

The yodse electronic platform and its tools allow businesses, operating in the production of industrial product groups to find their retail and wholesale customers and to provide direct sales without intermediaries. The system helps to set up a mechanism for communication with clients, enhance the transparency of transactions, perform transparent management and control in the process of delivery and payments, and expand the customer base, maximize the volume of goods turnover and net profit. In addition, owing to the global system based on the blockchain technology, small and medium-sized businesses will be able to solve the problems of entering new promising markets, as well as significantly improve the competitiveness of manufactured industrial products.

Advantages of using ecosystem (platform) yodse for consumers

Yodse project gives huge advantages for users while searching and purchasing industrial products group, motor vehicles, production, road construction, mining and agricultural machinery, material handling equipment, rigging arrangement, turbines, equipment for ventilation and air conditioning, pumps, compressors, bearings and others. Direct prices from manufacturer without intermediaries allow to maximize profit and users feedbacks and quality technical support from manufacturers will enable consumers to learn more about the product and make sure of its quality.

Benefits for users from yodse ecosystem scaling

Joining of a number of manufacturers of industrial groups of goods to the yodse system will make it possible to conclude a lot of mutually beneficial, multimillion contracts. As the yodse platform dynamically develops and scales, there will be a gradual increase in the number of offices being opened in many regions in order to provide quality and continuous technical support to users in other countries and maintain the brand. The scaling of ecosystem will enhance the frequency of use of the platform in a number of countries, which will increase the number of users, thereby facilitating the establishment of export-import transactions between countries and, as a result, increase sales volumes of manufacturers. Manufacturers, who sign in earlier than others, will take the advantages of being pioneers in new markets.

https://yodse.io/

☑️DO YOU WANT TO RECOVER YOUR LOST FUNDS ON BINARY OPTIONS AND BITCOIN INVESTMENTS??? OR YOU NEED A LEGIT HACKING SERVICE ?? TAKE YOUR TIME TO READ��

Delete☑️ The COMPOSITE CYBER SECURITY SPECIALISTS have received numerous complaints of fraud associated with websites that offers an opportunity to buy or trade binary options and bitcoin investments through Internet-based trading platforms. Most Of The complaints falls into these Two categories:

1. 🔘Refusal to credit customers accounts or reimburse funds to customers:

These complaints typically involve customers who have deposited money into their binary options trading account and who are then encouraged by “brokers” over the telephone to deposit additional funds into the customer account. When customers later attempt to withdraw their original deposit or the return they have been promised, the trading platforms allegedly cancel customers’ withdrawal requests, refuse to credit their accounts, or ignore their telephone calls and emails.

2. 🔘Manipulation of software to generate losing trades:

These complaints allege that the Internet-based binary options trading platforms manipulate the trading software to distort binary options prices and payouts in order to ensure that the trade results in a Loss. For example, when a customer’s trade is “winning,” the countdown to expiration is extended arbitrarily until the trade becomes a loss.

☑️ Most people have lost their hard earned money through binary options and bitcoin investments, yet they would go and meet fake recovery Experts unknowingly to help them recover their money and they would end up losing more money in the process. This Is Basically why we (COMPOSITE CYBER SECURITY SPECIALISTS) have come to y’all victim’s rescue. The clue is most of these Binary option brokers have weak Database security, and their vulnerabilities can be exploited easily with the Help of our Special HackTools, Root HackTools And Technical Hacking Strategies because they wouldn’t wanna spend money in the sponsorship of Bug bounty Programs which would have helped protect their Database from Unauthorized access to their Database, So all our specialists do is to hack into the Broker’s Database via SQL Hook injections & DNS Spoofing, Decrypt your Transaction Details, Trace the Routes of your Deposited Funds, Then some Technical Hacking Algorithms & Execution Which we cant explain here would follow then you have your money recovered. 💰✔️

☑️All our Specialists are well experienced in their various niches with Great Skills, Technical Hacking Strategies And Positive Online Reputations And Recommendations🔘

They hail from a proven track record and have cracked even the toughest of barriers to intrude and capture all relevant data needed by our Clients.

We have Digital Forensic Specialists, Certified Ethical Hackers, Software Engineers, Cyber Security Experts, Private investigators and more. Our Goal is to make your digital life secure, safe and hassle free by Linking you Up With these great Professionals such as JACK CABLE, ARNE SWINNEN, SEAN MELIA, DAWID CZAGAN, COSTELLO FRANK And More. These Professionals are Well Reserved Professionals who are always ready to Handle your job with great energy and swift response so that your problems can be solved very quickly.

All You Need to Do is to send us a mail and we’ll Assign any of these specialists to Handle your Job immediately.

☑️ Below Is A Full List Of Our Services:

* FUNDS RECOVERY ON BINARY OPTIONS AND BITCOIN INVESTMENTS

* WEBSITE HACKING

* CREDIT CARD MISHAPS

* PHONE HACKING (giving you Unnoticeable access to everything Happening on the Target’s Phone)

* CLEARING OF CRIMINAL RECORDS

* SOCIAL MEDIA ACCOUNTS HACKING

☑️ CONTACT:

••• Email:

composite.cybersecurity@protonmail.com

🔘2020 © composite cybersecurity specialists

🔘Want faster service? Contact us!

🔘All Rights Reserved ®️

Check the most popular crypto trends and news before investing

ReplyDeleteHI. I'M STUART NEWBY EX KLEINWORT BENSON LONDON. THEN MONTANI MONACO. I'M AN EX BIG MAFIA MONEY LAUNDERER ( I DID THAT IN LONDON, IN SINGAPORE AND LATELY HERE IN MONACO THRU MY EX EXTREMELY CRIMINAL COMPANY CALLED MONTANI )! I HAVE BEEN WASHING LOT OF MAFIA ASSASSIN CASH WITH THIS PEDOPHILE FREEMASON FELON, MALAVITOSO HOODED BROTHER OF MINE CALLED PAOLO BARRAI. BORN IN MILAN ON 28.6.65. BOUT WHO I WANT TO TELL A LOT, NOW. I WANT TO MAKE BIG REPENTANT MAFIOSO'S CONFESSIONS BOUT ALL THIS AND RIGHT NOW!!!!!!!!!!!!!!!!!!!!!!!!

ReplyDelete1

IS A PEDOPHILE SODOMIZING CHILDREN: PAOLO PIETRO BARRAI (BITCOIN: THAT "IT" USES X MAFIA-MONEY-LAUNDERING THRU VERY CRIMINAL EIDOO, VERY CRIMINAL CRYPTOLAB S A, VERY CRIMINAL CRYPTOPOLIS, VERY CRIMINAL MEDICALCHAIN, VERY CRIMINAL BITMAX, VERY CRIMINAL WMO GROUP)! EXTREMELY DANGEROUS PEDERAST PAOLO PIETRO BARRAI WELL KNOWN ALL AROUND THE WORLD AS " THE PEDOPHILE OF BITCOIN"! MAFIA MONEY LAUNDERER PAOLO BARRAI BORN IN MILAN ON 28.6.65 USES BITCOIN TO ORGANIZE THE RAPING OF CHILDREN AND TO PROMOTE PORNOGRAPHY FOR PEDOPHILES LIKE HIM! WE GOT LOT OF PROOVES BOUT IT!!! YES, IS HOMOSEXUAL OF PEDOPHILE KIND PAOLO BARRAI: BLOG "MERDATO" LIBERO ALIAS "STALKING SHIT SPREADED IN A FREE WAY WITH NAZIST JOSEPH GOEBBELS'S STYLE". STALKING SHIT BASED ON IMMENSE FAKE IN ORDER TO KILL EVERYONE IS NOT HITLERIAN & ANTI SEMITIC LIKE HIM! PAOLO BARRAI IS A BASTARD ASSASSIN, PAOLO BARRAI IS A PRINCIPAL OF MANY MURDERS! PAOLO BARRAI HAS ALREADY GONE 3 TIMES TO JAIL! PAOLO BARRAI HAS BEEN FIRED BADLY BY CITIBANK MILAN! PAOLO BARRAI HAS BEEN VERY HEAVILY FINED BY CONSOB! PAOLO BARRAI HAS ESCAPED FROM BRASIL AT NIGHT, GETTING A FIRST AVAILABLE FLIGHT, IN THE MIDDLE OF CARNAVAL DAYS, TO NOT FINISH IN JAIL: FOR EXTREMELY SERIOUS CRIMES LIKE HAVING RAPED AN 8 YEARS OLD CHILD, AS WELL AS FOR ENORMOUS FRAUDS, MAFIA MONEY LAUNDERING, NAZIST AND RACIST PROPAGANDA, EXECUTION OF KILLING THREATS, BLACKMAILS AND EXTORSIONS.... AND, LITTLE SWEET CHERRY ON CAKE: PEDERAST SEX HE HAD WITH AND 8 YEARS OLD CHILD.

BASTARD ASSASSIN WORM PAOLO BARRAI IS ALSO A MEGA SCAMMER, BURNING ALL SAVINGS OF EVERYONE FALLING IN HIS -CYBER-MEDIATIC-FINANCIAL TRAPS! AL CAPONE OF FINANCE: PAOLO BARRAI BORN IN MILAN ON 28.6.1965 ( LAUNDERING CASH FROM COSA NOSTRA, CAMORRA, NDRANGHETA, AS WELL AS CRIMINAL CASH FROM NAZIRACIST MOVEMENTS LEGA NORD AND FORZA ITALIA, IN EXTREMELY CRIMINAL EIDOO SWITZERLAND AND EXTREMELY CRIMINAL CRYPTOPOLIS SWITZERLAND)!!!

AND.. AGAIN.. AND..AGAIN..AND..AGAIN...

IS ONE OF MOST BASTARD CRIMINAL CONNECTED TO PANAMA PAPERS, STINKY WORM PAOLO BARRAI, ALREADY THREE TIMES IN JAIL, BORN IN MILAN ON 28.6.1965

YES, I AM WRITING BOUT CRIMINAL ASSASSIN PEDOPHILE PAOLO BARRAI FROM MEDICALCHAIN, CRIMINAL ASSASSIN PEDOPHILE PAOLO BARRAI FROM CRYPTOLAB S A,

CRIMINAL ASSASSIN PEDOPHILE PAOLO BARRAI FROM CRYPTOPOLIS, CRIMINAL ASSASSIN PEDOPHILE PAOLO BARRAI FROM BITMAX, CRIMINAL ASSASSIN PEDOPHILE PAOLO BARRAI FROM VERY FAILING ICO EIDOO, ICO MEGA MAFIA MONEY LAUNDERER FOR NDRANGHETA, VIA STINKY DELINQUENT NETALE FERRARA FROM REGGIO CALABRIA.

CAREFUL TO THIS LOUSY VERY NASTY, SAVAGE DELINQUENT: PAOLO PIETRO BARRAI EX CITIBANK MILAN, BORN IN MILAN ON 28.06.1965, CONDEMEND TO JAIL ALREADY MANY TIMES!

ONE OF DIRTIEST MAFIA AND CRIMINAL COLLARS MONEY LAUNDERER IN PANAMA ( AND NOT ONLY IN PANAMA)... EXTREMELY DELINQUENT INDIVIDUAL, ALREADY THREE TIMES IN PRISON ( EITHER IN ITALY AND ESPECIALLY IN BRAZIL), STINKY FELONIOUS PAOLO BARRAI (OR STINKY FELONIOUS PAOLO "PIETRO" BARRAI), BORN IN MILAN ON 28.06.1965.

FROM VERY VERY CRIMINAL WMO SA PANAMA, VERY VERY CRIMINAL WORLD MAN OPPORTUINITES VIA MAZZINI 14 LUGANO, VERY VERY CRIMINAL BSI ITALIA SRL VIA SOCRATE 26 MILAN, VERY VERY CRIMINAL BLOG MERCATO LIBERO ( NOT FOR NOTHING, EVERYONE IN ITALY AND INITALIAN SPEAKING PART OF SWITZERLAND, KNOWING HOW MANY CRIMES AND WHAT HORRIBLE KIND OF CRIMES, PAOLO BARRAI, ALWAYS DOES, CALLS THIS BLOG: "MERDATO" LIBERO).

How to repair Binance account accessing drawback

ReplyDeleteIf you're interested by fixing all the problems throughout a jiff, you'd wish to dial Binance Support Number +1【(817) 776-5501. If you're not awake to any resolution associated with the error you'll be ready to simply get connected with the professionals by dialing Binance Support variety instantly. The consultants will provide high-quality facilitate to the users thus users get obviate all the errors from the roots. they're very cooperative and place all efforts in fixing the matter of the users.Website: https://www.checkexchangeinfo.com/webexchanges/binance-support-number/

it’s the protection of two-factor authentication and multi-address signature what's loads of. you’ll use link appraiser app to secure your account. you’ll along transfer their app on IOS or golem or if you would like use Infobahn web site too. Blockchain support number +1 (817)-776-5501 is altogether clear to use. However, users have to be compelled to be compelled to pay some dealing fee on every deposit and withdrawal. official website: https://www.checkexchangeinfo.com/webexchanges/blockchain-support-number/

ReplyDeleteit is to boot clear that these shoppers from time to time got to confront the school glitches that are essential to extend in worth by commonplace clients. to stay up a key tight ways that from the disjointed qualities, shoppers got to contact the Coinbase support number+1 (817) 776-5501 specialists connected with a foreign coinbase client support variety affiliation can ne'er provide you with down paying very little temperament to what a chance to type of school glitches you're continuing with. additional info visit here: https://www.checkexchangeinfo.com/webexchanges/coinbase-support-number/

ReplyDeleteBittrex Support Number:- +1 (817)-776-5501 :Bittrex could be a world leader within the Blockchain revolution. we have a tendency to operate the premier U.S.-based blockchain commerce platform, that is meant for purchasers United Nations agency demand lightning-fast trade execution, dependable digital wallets, and industry-leading security practices. more info visit here: https://www.checkexchangeinfo.com/webexchanges/bittrex-support-number/

ReplyDeleteآهنگ تولدت مبارک خارجی

ReplyDeleteدانلود آهنگ تولدت مبارک عشقم

دانلود آهنگ تولدت مبارک افغانی

دانلود آهنگ تولدت مبارک کردی

دانلود آهنگ تولد

Download Latest Hiphop Songs

ReplyDeleteNice and awesome post you got. Thanks for sharing anyways

ReplyDeleteElaine Right Now Mp3 Download

Elaine Risky Now Mp3 Download

Download Latest South Africa Music

Best SEO Agency in Lagos Nigeria

Football News

How to Increase Sales on Poshmark

Because today's pgslot online slots pg , pggame268 are interesting and new, adding fun. and the excitement of playing online casino games for more gamers There are therefore a variety of options for gamers to choose from.

ReplyDeleteลักษณะเด่นของ slot บนเว็บไซต์ pgslot

ReplyDeleteลักษณะเด่นของ pgslot เป็นเป็นเกมที่เล่นแล้วเพลินใจไปกับเกม เครียดลดลง เป็นเกมที่มีข้อดีของแต่ละเกมต่างกันออกไป และก็แน่ๆว่าคุณที่เข้ามาเล่นเกมของทางพวกเราควรมีเกมที่ถูกใจแตกต่างออกไป บอกเลยว่าคุณลักษณะเด่นของเกม slot มีอะไรให้ท่านตื่นเต้นได้อีกเยอะแยะ หากว่าคุณต้องการทราบว่าเกมของทางพวกเรามีข้อดีอะไรบ้างอย่าพลาดเนื้อหานี้เด็ดขาดเลย

ข้อดีของเกม pgslot

สำหรับข้อดีที่ทำให้นักพนันหลายท่านนั้นหันมาพึงพอใจ แล้วก็เลือกเล่นเกมมีดังต่อแต่นี้ไป

1. เป็นเกมที่มีความมากมายหลากหลาย

จุดแข็งสิ่งแรกเลย ที่ไม่เคยทำให้คนอีกจำนวนไม่น้อยผิดหวังก็คือ ต้นแบบที่มากมาย รวมทั้งภาพที่งาม มีตัวละครที่นิยมที่ค่าย pgslot ได้มีไว้ให้เพื่อเพิ่มความสนุกสนานแล้วก็ความบันเทิงสำหรับในการเล่น

2. สามารถเล่นด้วยทุนที่ต่ำ

เกมสล็อตหลายๆเกมจะให้เล่นด้วยการวางเดิมพันที่ 100 บาท ถ้าคุณมีทุนเพียงแค่หลักร้อย แต่ว่าคุณก็จะต้องดูด้วยว่าเกมและก็คาสิโนออนไลน์ที่เลือก จะกำหนดเอาไว้ที่เท่าไร แม้กระนั้นคุณไม่จำเป็นต้องกลุ้มใจ ถ้าคุณมีเงินอยู่ 100 บาท แล้วลงเล่นด้วยยอดอย่างต่ำ คุณก็สามารถเล่นเกมนี้ได้ รวมทั้งมีสิทธิ์ลุ้นเงินรางวัลถึงหลักพันกันอย่างยิ่งจริงๆ pgslot

3. มีแนวเกมที่มีความนำสมัย

ด้วยเทคโนโลยีปัจจุบันปรับปรุงไปได้ไกลก็เลยทำให้ตัวเกมมีความนำสมัยเพิ่มขึ้นเรื่อยๆ จากที่คุณจำเป็นจะต้องเดินทางไปเล่นที่คาสิโน ทำให้ท่านมีทั้งยังการเสี่ยงและก็บางครั้งอาจจะไม่ถูกกฎหมาย แม้กระนั้นในช่วงเวลานี้พวกเรามีเทคโนโลยีทันสมัยเพิ่มขึ้นเรื่อยๆคุณไม่ต้องเสี่ยงที่จะเดินทางไปคาสิโนอีกต่อไป เว้นแต่พวกเราจะมีเกมที่ล้ำยุคล้วพวกเรายังมีความมากมายหลายในลักษณะของเกมอีกด้วย

4. สามารถเล่นผ่านวัสดุอุปกรณ์อิเล็กทรอนิกส์ได้

เกม pg slot ของพวกเราสามารถเล่นได้ผ่านทาง โทรศัพท์เคลื่อนที่ โน๊ตบุ๊ค คอมพิวเตอร์ อื่นๆอีกมากมาย รวมทั้งยังไม่ต้องโหลด สามารถเล่นผ่านแพลตฟร์อมการให้บริการชั้นหนึ่งในตอนนี้ได้ทั้งหมดทั้งปวง ซึ่งจำเป็นต้องกล่าวว่า โทรศัพท์เคลื่อนที่เป็นที่ชื่นชอบสำหรับการเอามาเล่นเกมสล็อตออนไลน์เยอะที่สุดเนื่องจากโทรศัพท์เคลื่อนที่เป็นอะไรที่นำเอาสบาย ถ้าหากว่าคุณรอคอยติดไฟแดงคุณก็สามารถถือโทรศัพท์ขึ้นมาปั่นเกมสล็อต ได้คุณอย่าลืมว่าเพียงแค่ไม่กี่นาทีก็สามารถพาคุณเป็นคนมั่งมีได้ จากการเล่นสล็อตออนไลน์

5. แจกแจ็คพอตแบบไม่ยั้ง pg slot

นอกเหนือจากที่จะมีการให้บริการที่ยอดเยี่ยมแล้ว ยังแจกโบนัสรวมทั้งแจ็คพอตที่บอกเลยมาคุ้มมากมายๆถึงนานๆหนจะมา แต่ว่าหากว่ามาแล้วมันจะเปลี่ยนแปลงคุณเป็นคนมั่งคั่งไปในเลวข้ามคืนอย่างยิ่งจริงๆ แล้วก็คุณก็ไม่อาจจะหาอย่างนี้ได้ในเกมอื่นๆในคาสิโนออนไลน์แน่ๆ

เป็นยังไงกันบ้าง ภายหลังที่คุณได้อ่านบทความของพวกเราแล้ว บอกเลยว่าคุ้มที่จะเล่นมากมายๆมีข้อดีที่มากมายขนาดนี้ แล้วก็ยังมากับการให้บริการที่ดีอีก ถ้าหากว่าคุณต้องการเจอกับความสนุกสนานร่าเริงรวมทั้งความมากมายหลายอีกเยอะแยะที่คอยคุณอยู่ จำต้องเลือกพนันเกม สล็อตออนไลน์บน pgslot เพียงแค่นั้น