Reader Q&A - The Power of Money

Below is a (largely) un-edited Q&A correspondence on Cryptos and The Power of Money between me and a reader. Thanks to him for consenting for me to share. Even though English isn't his first language, I think he's done a solid job of outlining some questions that may be on the mind's of other readers.

------------------------------------------------

I just finished your

script and again I am deeply impressed with what you wrote also the sarcasm

towards the famous 1% of this world with the truth in it made me laugh. I

already shared your paper with my brother and my friends but here are some

questions from a simple mind:

Let’s say that bitcoin

and crypto currency take over the current monetary system how is that going to

work out at the end? Right now crypto currencies are valued against the fiat

currency but if they are going to take over then the fiat currency is going to collapse

- how will we then value crypto currencies and who is going to decide that?

I also read about your

3 different scenarios of the future and I hope it’s going to be the third one

as well, but how is the crypto currency going to develop after they take over

the current system? I am worried that it would become just a digital version of

the corrupted sick system as we have now because people still need loans and mortgage

for their houses and all that I don’t know if I am a doom thinker but I just

try to wrap my head around it.

Furthermore me my

brother and my friends investigating a lot of new currencies as my brother if

very opportunistic he thinks the crypto currency streets are paved with gold

but i try to reason with him but since he knows more about this technology so could you help me out a little bit with

how to look at upcoming currencies because as i read the internet they have all

these standard things like prove of stake github white paper and developers by

name on their site but good scammers also read this and then they implement it

on their and it can still be a scam as

you found out with stratis.

Best regards ********

----------------------------------------------------------------------------------------------

Hi again ********

I’m glad you enjoyed the piece, though I didn't think I was being mean or sarcastic to anyone. I was really just trying to

communicate what is truth to me. I meant what I wrote about amnesty - but

didn't actually define it. To me, amnesty is not specifically the

forgiveness of individuals from repercussions or punishments for their

perceived crimes, but an appreciation for the shared predicament we all face in

this life. We all 'just got here'. We all have been born into and molded by

environments that lead us to approach life a certain way. I do my best to not

cast judgement on people, certainly not based on what family and worldview they

happened to be born into. I do however believe that at certain points in life,

you realize that you have to make a choice, and acknowledge what is balanced or

not.

I suspect that what I’ve just expressed may be very

difficult to translate - much less understand… in any case, I’ll try and answer

some of your questions:

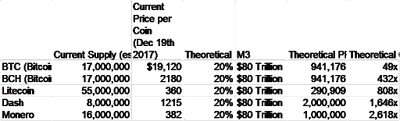

Cryptos are valued against fiat currency simply because most

‘stuff’ is currently priced in fiat currencies. As people increasingly

appreciate it for its money characteristics, this will change. Bitcoin is still

far away from its potential value relative to fiat currencies. As more people

convert their transactions such that they’re done in Bitcoin, we will

increasingly find a world where people price their goods and services in

Bitcoin. We’ve barely even scratched the surface of this shift.

One thing I was a bit disappointed in re: the response to my

piece in general was how little attention the idea of pricing things in bitcoin

(and at a discount to fiat) got - at least so far. I thought (and still think) selling

goods and services at a 10% discount if the buyer pays in BTC will be a great

way to facilitate the movement. Everyone wins, and people are motivated to get

involved – because it’s in their financial best interests to do so.

Regardless, if and as Bitcoin becomes a more frequent

mechanism for pricing goods and services, people will increasingly think of

Bitcoin as their ‘main’ currency. If you could pay for everything in your life

- from paying your rent to buying a chocolate bar, in Bitcoin – and the world

accommodated that lifestyle (maybe even at a 10% discount to fiat!), wouldn’t

you begin to consider Bitcoin as your main currency, and all stuff (including

dollars) priced against it?

What will decide

this? Adoption. Whether that’s because of egalitarian realization or profit

motive, people will adopt it and begin using it to transact. At some point

critical mass will be achieved, and there will be a whole ‘bitcoin country’

within all geographic domains.

On your question relating to lending/mortgages, etc. – I had

actually thought about addressing these aspects in The Power of Money,

but decided against. To the extent lending will likely continue to play a

significant role in how people live, this needs to be addressed. That we currently

live as a world of borrowers is a reflection of how not-present we are. Where

we are ‘here and now’ isn't right -

so we feel the need to pull forward from what we perceive as our future and in

so doing indebt ourselves.

I think we're so far away from a loan-free world now that

it's at risk of being a distraction (at present).. though maybe not for long. I'll

give it a think. But in the meantime, think of it this way - would you still

need to 'borrow so much' to buy [a house] (I put house, but u pick your asset)

if not for all the price inflation over the past 50 years? I suspect not. So

where does the problem really lie - in not having a lending mechanism to allow

you to 'afford' expensive things? Or in a money that generates inflation and

makes things expensive in the first place?

As to your point of 'paved with gold', check out my last

twitter comment. There are a lot of scams out there (deliberate and otherwise),

and even still no guarantees for anything. We all need to be careful. Fear and

greed are destroyers of both rational thought and investment returns in any

market - crypto or otherwise.

Finally, in terms of where to look for good information on

coins etc. going forward – I agree with you that there appears to be a shortage

of good analysis out there. I'm sure that will change, but even when it does, we all need to continue to think for ourselves and critically.

Best,

Izzy

This is extremely informative blog post I have read after a long time duration. I will bookmark this blog for the future and comeback as soon as I get free with my current project which is on best Indian Food Malta. Also share to my friend to must visit here.

ReplyDelete